A Developer's Guide to Commercial Solar Installation Costs (2025)

As a developer, EPC, or facility manager, you know that a commercial solar project isn't about buying panels—it's about engineering a high-performance financial asset. This guide provides a no-nonsense breakdown of commercial solar installation costs, showing you how to manage hardware procurement, navigate soft costs, and leverage incentives to deliver profitable, compliant projects in today's market. We'll move beyond generic averages to give you the actionable frameworks needed to control budgets and maximize ROI.

A Closer Look at Commercial Solar Costs

For anyone involved in a project—whether you're a developer, an EPC, or a facility manager—getting a handle on the financial anatomy of a solar installation is the first step toward optimizing your investment. While the "cost per watt" metric is a great starting point for comparison, the real budget is a mix of different expenses.

Every piece of the puzzle, from the physical hardware to the skilled labor needed for a successful commercial solar panel installation, adds up. Knowing where your money is going is crucial for smart financial planning, especially since soft costs and labor often make up a huge chunk of the total.

To give you a clearer picture, here’s a typical breakdown of where every dollar goes in a commercial solar project.

Critical Cost Breakdown for Commercial Solar Projects

This table provides a real-world cost allocation for a standard commercial solar installation. Understanding this framework is critical for accurate bidding and budget management.

| Cost Component | Description & Key Considerations for Project Managers | Estimated Percentage of Total Cost |

|---|---|---|

| Solar Modules (Panels) | The core energy-generating asset. Cost varies significantly by efficiency (e.g., PERC vs. TOPCon) and brand tier (Tier 1 vs. Tier 2). | 30-35% |

| Inverters | Converts DC to usable AC power. A critical point of failure; brand choice (e.g., Fronius, Sungrow) impacts reliability and long-term O&M costs. | 10-15% |

| Balance of System (BOS) | All non-module hardware: racking, mounting, wiring, conduit. Costs are driven by site complexity and design efficiency. | 10-12% |

| Labor & Installation | Skilled labor for physical installation. Highly variable by region and project complexity. Efficient crews reduce cost. | 15-20% |

| Engineering & Design | System layout, structural analysis, and electrical blueprints. NABCEP-certified design review can prevent costly rework. | 8-10% |

| Permitting & Inspection | Fees paid to the Authority Having Jurisdiction (AHJ). Can cause significant delays if not managed proactively. | 5-8% |

| Overhead & Profit | The installer's or EPC's operational costs and margin. A reflection of the project's management quality and risk. | 10-15% |

As you can see, the physical equipment is just one part of the equation. The "soft costs"—like engineering, permitting, and labor—are just as significant.

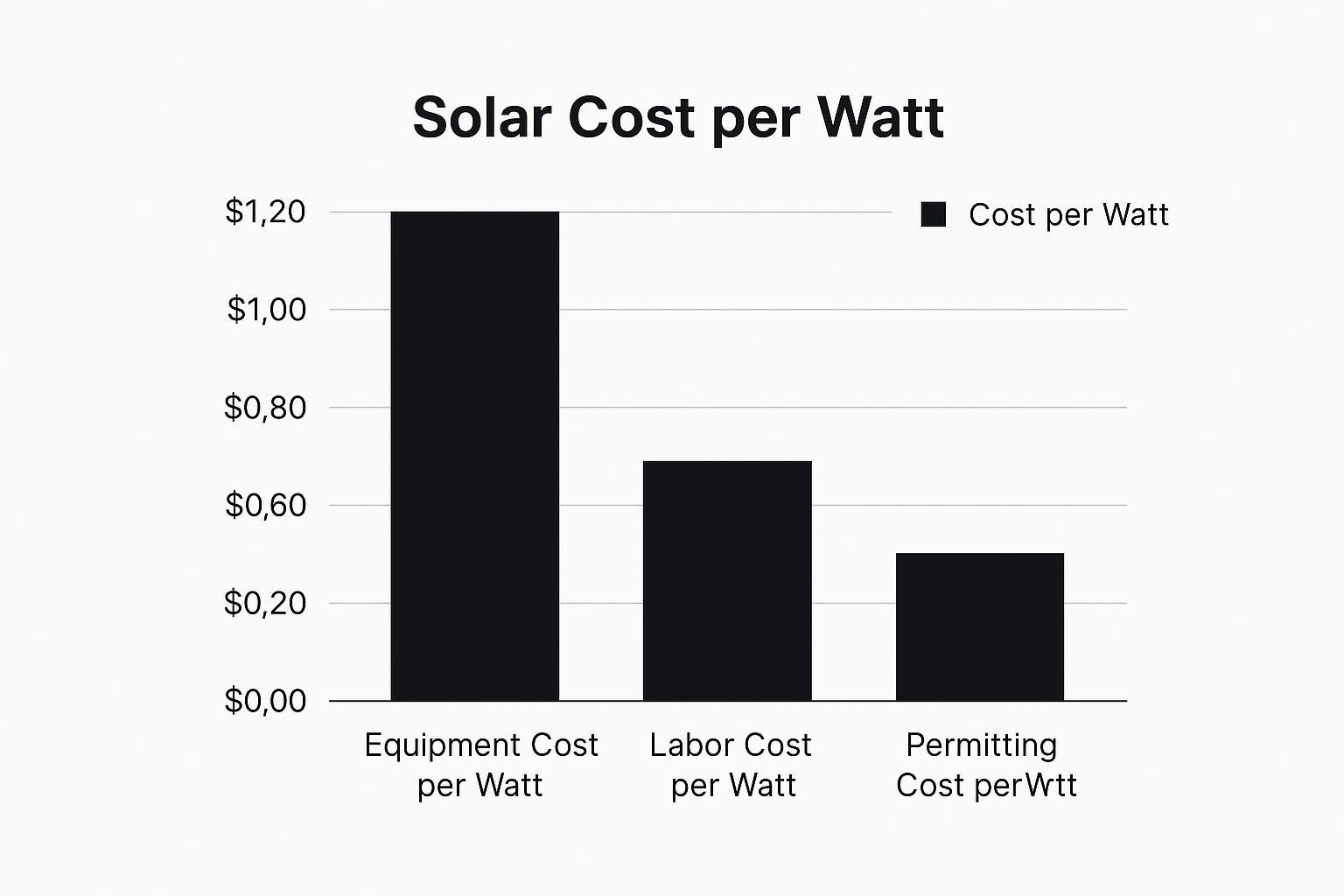

The chart below offers another way to visualize how these costs break down on a per-watt basis for the main components.

This really drives home the point that while panels get all the attention, it’s the combined weight of labor and permitting that significantly beefs up the final cost per watt.

Riding the Waves of Market Changes

There’s a fascinating trend happening in the market right now. Even though global trade policies have nudged solar module prices up by 2-5%, the average installed cost for commercial systems has actually dropped by 2% year-over-year.

How is that possible? It’s all thanks to technology. The industry is rapidly adopting higher-efficiency TOPCon modules. These panels are powerhouses, generating more electricity in the same amount of space. That means you need less racking, less wiring, and less labor to hit your energy goals, which brings down the total project cost.

Critical Mistake to Avoid: Focusing only on the price of the panels is a classic mistake. Real cost savings come from looking at the entire system. You have to consider the efficiency of the technology, the balance of system components, and how smoothly the installation can run. For anyone managing a project, this means your choice of distributor is critical. Partnering with a company like Portlandia Electric Supply that gives you access to the latest tech is the surest way to build a competitive and profitable project.

Analyzing Your Hardware and Equipment Costs

While looking at high-level budget percentages gives you a good starting map, real cost control happens when you get your hands dirty and dig into the specific hardware. The equipment you select is almost always the single biggest line item on your project budget. Getting a firm grip on these components is absolutely essential for making smart buys that affect both your upfront spending and your system's long-term performance.

This is where your project starts to take physical shape. Every single choice, from the brand of solar panels you pick to the type of inverter, carries a lot of weight and directly impacts the final cost of your commercial solar installation.

The Core Components and Their Costs

The big-ticket items that drive your budget are the solar modules, inverters, and racking. But you can't forget about the often-overlooked Balance of System (BOS) components. This is the "everything else" category—wiring, conduits, disconnects, monitoring hardware—that plays a vital role in your total project cost. For a complete list of all the individual parts, a comprehensive guide on solar PV components is a great resource.

Here's how different people on the project team typically think about these costs:

- For EPCs and Developers: Your most important decision usually comes down to the modules. Choosing between a premium Tier 1 module and a more budget-friendly Tier 2 option from a brand like BYD or Sungrow isn't just about the initial price tag; it's a strategic decision about bankability and the system's long-term energy production.

- For Procurement Managers: Your whole world revolves around getting these components at the best possible price without cutting corners on quality or blowing up the project timeline. This means navigating complex supply chains, hammering out bulk pricing deals, and optimizing freight.

- For Facility Managers: You need hardware that you can count on, period. Reliability and minimal maintenance are king. For you, downtime isn't just an inconvenience—it's a direct hit to the bottom line, which makes durable, well-warrantied equipment a top priority.

Strategic Procurement: Tier 1 vs. Tier 2 Modules

The debate between Tier 1 and Tier 2 solar modules is a constant in commercial solar projects. Tier 1 manufacturers are the big, established players. They're typically vertically integrated, have a long, proven track record, and solid bankability, which makes them the go-to choice for projects that need traditional financing.

However, many Tier 2 manufacturers are closing the gap, offering highly competitive technology, like high-efficiency TOPCon cells, at a lower cost. If your project has flexible financing or is laser-focused on achieving the lowest possible Levelized Cost of Electricity (LCOE), a high-performing Tier 2 panel can be a very smart move. Understanding the real differences between brands is critical, and our guide on the best solar panel brands can help you sort through the options.

Expert Tip for Procurement: Never look at module cost in a bubble. A slightly more expensive, higher-efficiency panel (like a modern TOPCon module) might let you use fewer panels overall. That means less racking, less wiring, and less labor—all of which lowers your total Balance of Plant (BOP) cost and can lead to bigger savings in the end.

Optimizing Your Supply Chain

For procurement managers, the game is often won or lost in logistics. The price you pay per panel or inverter is just one piece of the puzzle; freight and handling can add a significant percentage to your total hardware cost. This is where partnering with a national distributor like Portlandia Electric Supply can give you a serious edge.

By tapping into a distributor's established logistics network and buying power, you gain access to:

- Bundled Freight: Combining shipments of modules, inverters, and racking from one source dramatically slashes shipping costs compared to trying to coordinate multiple deliveries from different manufacturers.

- Bulk Purchasing Power: Distributors secure hardware at volume discounts that get passed on to you. Ordering by the pallet or container can drop your per-unit cost by a noticeable margin.

- In-Stock Inventory: Supply chain hiccups can cause expensive project delays. Working with a partner who keeps a deep inventory of critical components from brands like Fronius and FranklinWH in stock ensures your project stays on track, protecting you from the costly overruns that come with blown timelines.

Navigating Soft Costs Like Permitting and Labor

While the solar panels and inverters get all the attention, the real budget-killers in commercial solar are often the “soft costs.” These are the less tangible but absolutely critical expenses that can easily eat up more than half of your total project budget.

We're talking about everything from engineering and design to permitting fees, labor, and interconnection studies. Underestimating these elements is one of the most common—and costly—mistakes we see in project planning. In fact, how you manage these costs is what separates a profitable project from a financial headache.

For any developer, installer, or project owner, getting a firm handle on these expenses isn't just good practice; it's essential for keeping commercial solar installation costs under control.

The Critical Role of Labor in Your Budget

Labor is a huge piece of the soft cost puzzle, typically accounting for 15-20% of the total project price. This isn't just about paying a crew to bolt panels to a roof. It involves highly skilled work from licensed electricians, certified installers, and project managers who make sure the system is built safely, efficiently, and to code.

The price tag for labor can swing pretty widely based on a few key factors:

- Regional Wage Rates: It’s no surprise that labor costs are higher in markets with a higher cost of living and stronger prevailing wages.

- Project Complexity: A tricky rooftop with lots of vents and obstacles, or a ground-mount system on hilly terrain, is going to demand more hours and specialized skills than a simple, wide-open roof.

- Installer Experience: Seasoned, top-tier crews might have higher hourly rates, but their efficiency often means they finish the job faster and with fewer mistakes. This can save you a fortune in the long run by avoiding expensive delays and rework.

A Developer's Guide to Permitting and Interconnection

If you're a project developer or an EPC, the permitting and interconnection processes are where your timelines—and budgets—are most vulnerable. Every town and county has its own Authority Having Jurisdiction (AHJ), each with a unique set of rules, fees, and quirks. A delay in this stage can create a domino effect, stalling your equipment orders and pushing back your entire installation schedule.

Compliance Watchout for Developers: Stop treating interconnection as a final step. Engage with the local utility as early as possible, ideally during the initial design phase. Understanding their specific requirements for grid studies and equipment upfront can save you months of delays and thousands in redesign costs.

The key is to streamline this bureaucratic maze. Working with a distributor like Portlandia Electric Supply that provides NABCEP-certified design review is a game-changer. This service ensures your plans are compliant with the latest National Electrical Code (NEC) standards right from the start, dramatically cutting the risk of rejection by the AHJ and accelerating your path to approval.

Hidden Costs: Common Budget Breakers to Watch For

Beyond the usual line items, a few "hidden" soft costs can pop up and wreak havoc on your budget. The only defense is proactive planning.

| Hidden Cost | Why It Happens | How to Prepare |

|---|---|---|

| Structural Engineering Reports | The AHJ or your engineer flags the roof as unable to support the solar array's weight without reinforcement. | Budget for a professional structural assessment early in the design phase, especially for older buildings. |

| Utility Grid Upgrades | The local grid can't handle the new power from your system, forcing the utility to upgrade transformers or lines—on your dime. | Request an interconnection study from the utility as soon as you can to spot potential upgrade requirements. |

| Specialized Insurance | The project demands specific liability or equipment insurance that goes beyond a standard policy, common for large-scale or high-risk jobs. | Talk to an insurance provider who specializes in renewable energy projects to understand all the necessary coverage. |

By anticipating these potential landmines, you can build a more resilient and realistic budget. This foresight shifts your approach from reactive crisis management to strategic financial control, ensuring your commercial solar installation costs stay predictable and on track.

How Project Scale and Technology Reduce Costs

When you're a developer, EPC, or engineer, the cost-per-watt for a solar project isn't some fixed number you just have to accept. It's a variable you can—and should—actively push down with smart design and procurement. Two of the most powerful levers you can pull are project scale and technology selection.

Getting a handle on how these two factors work together is the difference between just buying equipment and truly engineering a more profitable asset. It’s all about making every dollar count, both on day one and over the system's 25-year life.

The Power of Economies of Scale

It’s a straightforward economic truth: buying in bulk saves money. In commercial solar, this principle, known as economies of scale, has a massive impact. A 1 MW project will almost always have a lower cost-per-watt than a 100 kW system, and those savings come from a few key places.

- Hardware Procurement: Suppliers give deep discounts for volume. When you’re ordering solar modules by the container and inverters by the pallet, your per-unit cost drops dramatically compared to smaller, one-off orders.

- Labor Efficiency: Installation crews find their rhythm on bigger jobs. Repetitive tasks, like mounting panels or running conduit, get faster and more efficient, which brings down the total labor hours needed for each kilowatt installed.

- Soft Cost Distribution: Fixed soft costs—think system design, permitting fees, and interconnection studies—get spread out over a much larger number of kilowatts. This dilutes their impact on the final cost-per-watt, making them a smaller piece of the overall pie.

Using Advanced Technology to Lower Costs

While scale is a huge advantage, you don't always need a massive project to see big savings. Superior technology can deliver similar cost reductions, even on smaller sites. The goal is simple: squeeze more energy production out of every square foot.

High-efficiency modules, like modern TOPCon panels, are a perfect example of how better tech directly lowers your total project cost. A more efficient panel generates more power from the same physical footprint. That means you can reach your target system size with fewer panels, creating a powerful ripple effect that cuts your Balance of Plant (BOP) costs.

Expert Tip for Engineers & Developers: Stop focusing only on the module's cost-per-watt. A module that's 10% more expensive but 15% more efficient can slash your total installed cost by reducing the amount of racking, wiring, and labor you need. That's a far better project ROI.

Global trends back this up, with technology consistently pushing prices down. Even with market hiccups, manufacturing breakthroughs are making solar more accessible. According to a 2025 BloombergNEF report, the global Levelized Cost of Electricity (LCOE) for solar is expected to fall by another 2% to 11% in 2025 alone.

This is exactly why partnering with a forward-thinking distributor is so important. Getting your hands on the latest, most efficient hardware isn't just a perk; it’s a core strategy for building more competitive and profitable projects. You can explore a range of advanced options that fit different project scopes in our guide to solar energy solutions.

Maximizing Your ROI with Incentives and Financing

The sticker price on a commercial solar project? That's just the starting point. The real, final cost is shaped by a powerful set of financial levers that can completely transform the project's economics. When you know how to use these tools, what looks like a major capital expense becomes a high-return, predictable investment.

For anyone involved in a project—from the developer to the facility owner—getting a handle on incentives and financing isn’t just an extra step. It’s a core strategy for making the numbers work in your favor.

Unlocking Federal and State Incentives

The single most important financial tool in your arsenal is the federal Investment Tax Credit (ITC). This is a game-changer, allowing businesses to deduct a huge chunk of their solar installation costs directly from their federal tax bill. The baseline credit is a generous 30%, but thanks to the Inflation Reduction Act (IRA), savvy developers can stack on "adders" for meeting specific criteria.

- Domestic Content Adder: Choosing to use U.S.-sourced materials can tack on another 10% to your tax credit.

- Energy Community Adder: If your project is located in a qualified energy community—like an area with a recently closed coal plant or on a brownfield site—that’s another 10% in your pocket.

Pro Tip for Developers: Stacking these adders is where the real magic happens. A project that qualifies for both could see its tax credit jump from 30% all the way to 50%. This fundamentally changes the financial model and dramatically speeds up the payback period. Portlandia Electric Supply offers full compliance support to ensure you maximize these valuable IRA adders.

Beyond the ITC, there's the Modified Accelerated Cost-Recovery System (MACRS). This lets businesses recover their investment through depreciation deductions. Right now, solar projects qualify for an incredible 80% first-year bonus depreciation. This provides a massive, immediate tax benefit that gives your cash flow a serious boost in the first year of operation.

To help sweeten the deal even further, you can also explore other options like valuable renewable energy grants. These programs can knock even more off the net cost of your system.

Choosing the Right Financing Model

How you pay for your system is just as crucial as the incentives you claim. Different financing models are built for different business goals, risk tolerances, and available capital. For property managers and facility owners, the path you choose will determine who owns the asset and how you'll see the savings on your energy bills.

The good news is that many of these financing models perfectly align with the long-term advantages of solar power energy, like predictable energy costs and operational resilience.

To make it clearer, here's a look at the most common financing structures and what they mean for you.

Commercial Solar Financing Options Compared

| Financing Model | Who Owns The System? | Typical Upfront Cost | Key Benefit |

|---|---|---|---|

| Direct Ownership (Cash/Loan) | The Business Owner | High | You own the asset and get all the tax incentives. |

| Solar Lease | A Third-Party (Developer) | Low to None | Fixed monthly payments offer budget certainty without ownership risks. |

| Power Purchase Agreement (PPA) | A Third-Party (Developer) | None | You only pay for the power you use at a fixed, often lower-than-utility rate. |

Each of these paths has its place, so let's dig into the two most popular options.

A Power Purchase Agreement (PPA) is often the perfect fit for businesses or non-profits that can't use the big tax credits themselves. With a PPA, a third-party developer owns and operates the solar system on your property. Your job is simple: you just buy the clean electricity it generates at a locked-in rate, which is usually cheaper than what you're paying the utility. It’s a fantastic way to get immediate savings with zero upfront investment.

On the other hand, direct ownership puts you in the driver's seat. You own the system outright, which means you claim all those lucrative tax benefits and keep 100% of the energy savings. While it demands a significant initial investment, this route almost always delivers the highest long-term ROI for businesses that have the capital and the tax liability to make it work.

Calculating Your Long-Term Payback and ROI

A commercial solar system isn't just a purchase; it's a 25-year asset. If you only look at the upfront price tag, you're missing the biggest part of the story. The real value is found by looking at the total cost of ownership and the return it generates over its entire lifespan.

This means we need to shift our focus from the initial check you write to the system's long-term financial performance. This is where we figure out the simple payback period—the time it takes for the system to pay for itself—and the overall Return on Investment (ROI).

Understanding Ongoing Operations and Maintenance Costs

While solar systems are famously low-maintenance, they aren't "no-maintenance." You have to budget for Operations & Maintenance (O&M) to make sure your system performs at its peak for decades to come. It’s a crucial step for protecting your investment.

These ongoing expenses are typically modest but absolutely essential. They include:

- Routine Panel Cleaning: Depending on your location, dust, pollen, and everyday grime can build up and cut into your system's efficiency. A periodic cleaning keeps production where it should be.

- Inverter Servicing: The inverters are the hardest-working part of your entire system. While modern inverters are incredibly reliable, they might need servicing or even replacement down the road, usually after 10-15 years.

- Performance Monitoring: Active monitoring software is your early-warning system. It tracks energy production in real-time, letting you spot and fix any performance dips before they become a real problem.

Honestly, your best defense against high O&M costs is selecting durable, high-quality equipment from the start. Choosing trusted brands like Fronius or Sungrow minimizes downtime and service calls, which directly protects your long-term returns.

Calculating Your Simple Payback Period

The payback period is the most straightforward metric for understanding your investment's timeline. It answers one simple question: how long until this thing pays for itself?

The formula is pretty clear:

Simple Payback Period (in Years) = (Total Upfront Cost - Total Incentives) / Annual Electricity Savings

Let’s run through a quick, real-world example.

- Total Upfront Cost: $250,000

- Total Incentives (ITC, Grants): $100,000

- Net System Cost: $150,000

- Annual Electricity Savings: $25,000

The math is simple: $150,000 / $25,000 = 6 years. After that sixth year, every single kilowatt-hour the system produces is pure profit for your bottom line.

Factoring in a Transformed Cost Landscape

Calculating ROI today is more attractive than it has ever been. The global cost landscape for commercial solar has changed so dramatically that it's a no-brainer for more businesses than ever.

Over the last decade, solar panel prices have plummeted by over 60%, and the cost of essential battery storage has dropped an incredible 72% since 2015. This rapid cost reduction is what’s driving the fantastic payback periods we're seeing in the market right now. You can explore detailed market trends from IEA-PVPS to see just how much the global picture has changed.

Ultimately, when you combine smart O&M planning with a clear-eyed view of your net cost and annual savings, you can accurately forecast your project's financial performance. This transforms your understanding of commercial solar costs from a simple expense into a powerful, long-term investment strategy.

Got Questions? We've Got Answers

Thinking about a commercial solar project brings up a lot of questions. It's a big investment, and you need to be sure you're making the right calls. Here are some of the most common questions we hear from developers, installers, and business owners, along with our straightforward, experience-based answers.

What’s a Good Payback Period for a Commercial System?

Honestly, a solid payback period for most commercial solar projects lands somewhere between 6 to 11 years. Where your project falls in that range really depends on your local utility rates, the state you're in, and the incentives you can snag.

We're seeing an average payback of around 10.48 years across the board right now. It's also worth noting that rooftop systems tend to pay for themselves a bit faster than ground-mounted ones. In states with high electricity costs and great solar programs, like Pennsylvania and Maryland, it's not uncommon to see payback periods well under 10 years.

For Developers & EPCs: Don't get too hung up on just the payback number. A project with a 7-year payback still has 18+ years left on its warranty, pumping out virtually free electricity. That's where the real long-term ROI kicks in, and it's a much more powerful story than just cost recovery.

What Happens If My Installer or the Equipment Manufacturer Goes Out of Business?

That’s a smart question and a real risk you need to plan for with any long-term asset. The last thing you want is a warranty that's not worth the paper it's printed on.

Here’s how you get ahead of it:

- Installer Risk: This is all about due diligence. Stick with established, reputable installers who have been around the block. As a distributor, Portlandia Electric Supply can also connect you with our vetted PowerLink network of installers—these are pros we know and trust, which takes a lot of the guesswork out of it.

- Manufacturer Risk: Bank on the big names. Choosing Tier 1 brands like Sungrow, Fronius, or BYD isn't just about performance; it's about financial stability. These companies have a proven history of weathering market storms and standing by their long-term warranties, giving you peace of mind that your equipment will be covered for decades.

Does My Roof Need to Be New to Install Solar?

No, your roof doesn't need to be fresh off the roll. What it does need is to be in good shape and have enough life left in it to outlast your solar system's payback period.

Think of it this way: if your roof has less than 10-15 years of life remaining, it’s almost always cheaper and smarter to replace it before the panels go up. Paying a crew to take down a whole solar array and then put it all back up just to replace a roof is a massive, completely avoidable expense. Any good solar developer will insist on a roof inspection to make sure it's structurally sound before they even think about starting the project.

Ready to stop asking questions and start getting answers for your next project? Portlandia Electric Supply has the in-stock hardware, design support, and logistical know-how to help you get your commercial solar installation costs under control and push your ROI to the max.