Equipment Leasing Tax Benefits: A Guide for Project & Procurement Managers

For any business owner, project developer, or procurement manager, the real power of equipment leasing lies in a simple accounting shift: turning a major purchase into a predictable operating expense. This lets you deduct 100% of your lease payments, which immediately lowers your taxable income without getting tangled up in complex depreciation schedules. You’re essentially converting a huge capital outlay into a straightforward, manageable operational cost, preserving capital for growth.

This guide is for installers, EPCs, developers, and procurement officers who need to acquire critical assets—like solar inverters, energy storage systems, or commercial EV chargers—while maximizing ROI and maintaining project budget discipline. We'll show you how to leverage leasing to make your bids more competitive and your projects more profitable.

Your Guide to Equipment Leasing Tax Benefits

Let's be direct—tax codes are complex, especially when you’re trying to acquire critical equipment for a new project or facility upgrade against tight deadlines and budget constraints. Equipment leasing cuts through that financial fog. It offers a clear path to getting the assets you need while unlocking significant tax advantages that improve your bottom line.

This strategy is effective for any business, from a large commercial EPC to a local electrical installer, that wants to preserve capital and improve cash flow.

Instead of sinking cash into an outright purchase, leasing breaks down the cost of new equipment like solar panels, BYD or FranklinWH energy storage systems, or EV chargers into a simple monthly payment. From a tax standpoint, that shift is a game-changer. Here’s the real-world impact for your business:

- Deductible Operating Expenses: With a true operating lease, your payments are treated as operating expenses, making them fully deductible from your taxable income.

- Capital Conservation: Keep your cash liquid for critical needs—payroll, bulk material buys, or project mobilization—instead of tying it up in depreciating assets.

- Financial Predictability: Fixed monthly payments make bidding, budgeting, and forecasting precise. No more financial shocks from large, one-time purchases.

- Avoiding Depreciation Hassles: Leasing lets you sidestep complicated IRS depreciation schedules (MACRS). It’s a cleaner, more direct way to handle equipment costs.

A Practical Framework for Financial Advantage

Think of leasing as more than just a way to get gear; it's a strategic financial tool. For project developers and procurement officers, this is a secret weapon for bidding on jobs or managing tight budgets. By structuring the financing as a lease, you can lower the after-tax cost of equipment, making your proposals more competitive and your projects more profitable.

Pro Tip for Procurement: This strategy is especially powerful for capital-intensive projects. When acquiring assets like standby Cummins generators or commercial HVAC units would otherwise drain your financial resources, leasing aligns your costs directly with project revenues and operational cash flow.

As we dive into the specifics of regulations like Section 179 and bonus depreciation, remember this core idea: leasing is a tax-savvy way to manage operating expenses. For more ideas on financial strategies, you can explore other expert articles on a range of energy solutions to find what works best for your business.

Leasing vs Buying Key Tax Differences

To see the benefits at a glance, here’s a side-by-side comparison of how the IRS generally treats equipment leasing versus an outright purchase. This decision matrix helps frame the conversation with your financial team.

| Financial Action | Tax Treatment with Equipment Leasing | Tax Treatment with Outright Purchase |

|---|---|---|

| Initial Cost | No large upfront cash outlay. | Requires a significant capital expenditure. |

| Annual Deductions | Lease payments are fully deductible as operating expenses (True/Operating Lease). | Depreciation is deducted over the asset's useful life (e.g., MACRS). |

| Tax Simplicity | Straightforward deduction of monthly payments. | Requires tracking complex depreciation schedules. |

| Section 179 | Typically not available to the lessee with an Operating Lease. Available with a Capital/Finance Lease. | Can deduct up to the full purchase price in the first year. |

| Bonus Depreciation | Not available to the lessee with an Operating Lease. Available with a Capital/Finance Lease. | Can deduct a percentage of the cost in the first year. |

This table makes it clear: while buying offers powerful first-year deductions, a true operating lease provides a steady, simple, and predictable tax benefit that preserves your cash flow year after year.

Using Section 179 for Leased Equipment

When it comes to smart tax planning, Section 179 of the IRS tax code is a game-changer. It allows you to deduct the entire purchase price of qualifying equipment in the year it's placed in service. While most associate this with buying outright, it’s also a powerful tool you can use with certain types of leases.

Think about it: instead of slowly depreciating an asset over many years, you get the full tax benefit immediately. This can significantly lower your current-year taxable income and free up cash for other critical business operations. The key is ensuring your lease qualifies.

Qualifying Your Lease for Section 179

To claim the Section 179 deduction on leased equipment, the IRS must view the lease as a purchase for tax purposes. This requires what's known as a capital lease, also called a finance lease or an Equipment Finance Agreement (EFA).

This is different from a standard operating lease where you're just renting the equipment and expensing monthly payments. A capital lease is structured to transfer ownership to you by the end of the term. A common feature is a bargain purchase option—often a $1 buyout—once the lease term concludes. It's this structure that makes the equipment eligible for the Section 179 write-off.

This ability to claim the full deduction is one of the biggest tax benefits of equipment leasing. By structuring your agreement as a capital lease, you can get 100% financing for essential assets, avoid a huge upfront cash outlay, and still get the same tax perks as if you bought it outright. You can find more details on how leasing maximizes capital and tax benefits on bankersbank.com.

Key Eligibility Rules and Deduction Limits

Section 179 is a powerful tool, but project managers and procurement officers must know the rules to stay compliant. There are several important limits to keep in mind for the current tax year.

- Deduction Limit: For 2024, the maximum Section 179 deduction is $1,220,000.

- Spending Cap: If you place more than $3,050,000 worth of qualifying equipment into service during the tax year, the deduction begins to phase out on a dollar-for-dollar basis.

- Business Income Limitation: Your total Section 179 deduction cannot exceed your net taxable business income for the year.

Pro Tip: When structuring a capital lease for something like Sungrow inverters or commercial generators, bundle all soft costs—delivery, installation, and even sales tax—into the total financed amount. These costs are also eligible for the Section 179 deduction, which maximizes your write-off.

Working with a financing partner who understands these rules is crucial. They can help you structure an Equipment Finance Agreement that meets all IRS criteria, letting you acquire the gear you need while taking full advantage of this valuable tax break.

Choosing Between Capital and Operating Leases

Not all equipment leases are the same, especially through the lens of your company’s tax strategy. The choice between a capital lease (or finance lease) and an operating lease is a critical decision for any project owner or procurement manager. This decision directly impacts your balance sheet, monthly expenses, and—most importantly—the specific tax benefits you can claim.

A capital lease is like a mortgage for your equipment; for tax purposes, you’re treated as the owner. This means you can build equity and claim depreciation. An operating lease is more like renting; you simply write off payments as a predictable business expense.

The IRS Framework for Lease Classification

So how do you know which one you have? The IRS has a clear set of rules. If your lease agreement meets just one of the following four criteria, it’s a capital lease:

- Ownership Transfer: The lease automatically transfers equipment ownership to you at the end of the term.

- Bargain Purchase Option: The contract offers a "bargain purchase option" to buy the asset for a price significantly below its fair market value (e.g., the classic $1 buyout).

- Lease Term: The lease term covers 75% or more of the equipment's estimated useful economic life.

- Present Value: The total present value of all lease payments equals 90% or more of the equipment's fair market value.

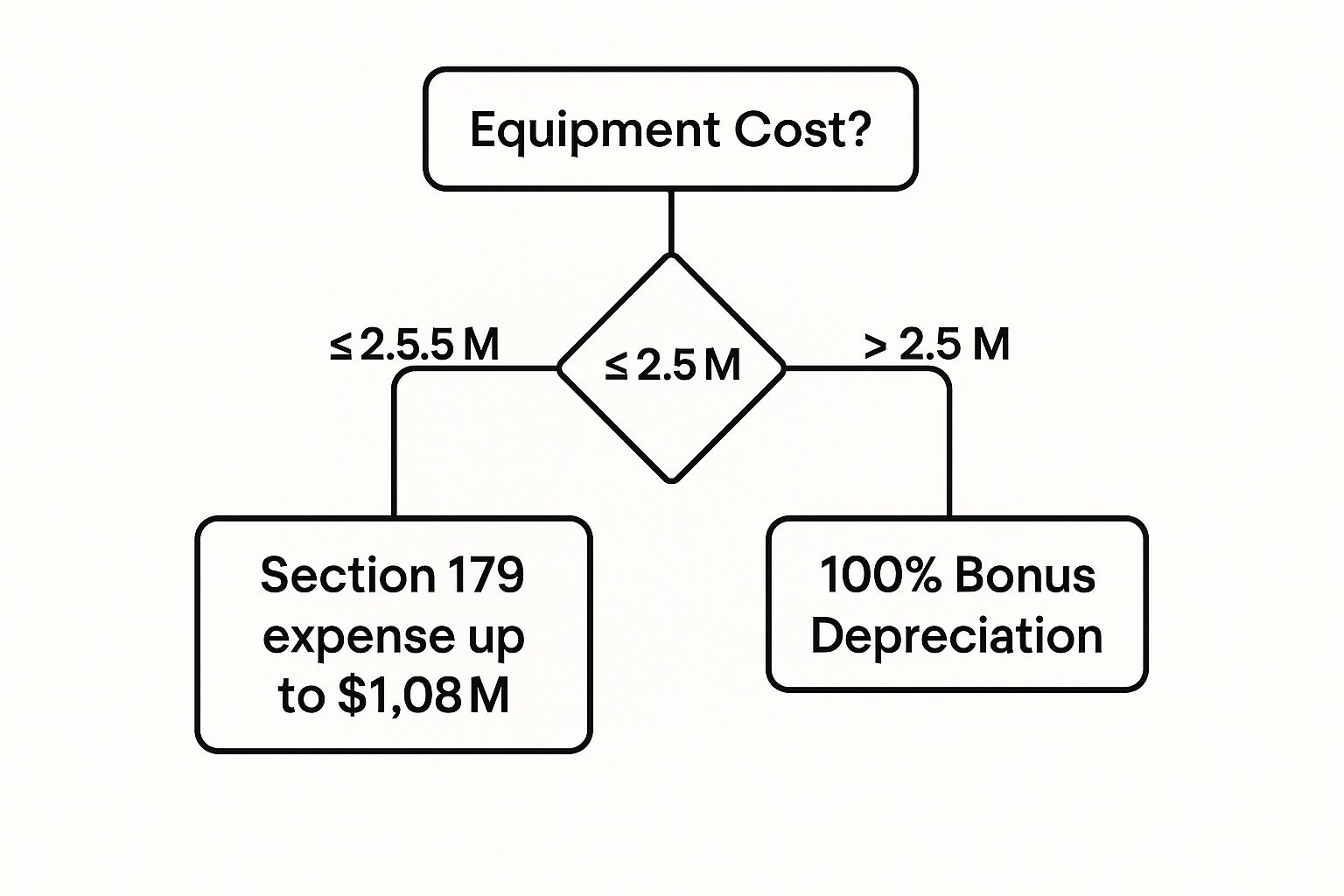

This decision tree helps visualize how to approach tax deductions after acquiring equipment, whether purchased outright or structured as a capital lease.

As you can see, while Section 179 is a powerful tool for many acquisitions, bonus depreciation often becomes the go-to strategy for larger-scale projects that exceed the spending cap.

Strategic Implications for Your Business

Choosing the right lease structure is a core financial decision.

Critical Mistake to Avoid: Don't assume the lease type; verify it. Choosing an operating lease when you wanted the Section 179 deduction (or vice versa) can lead to significant tax compliance issues and lost savings.

- For Installers & Small Contractors: An operating lease is often ideal. It simplifies bookkeeping and keeps assets off the balance sheet, providing clean, predictable monthly deductions.

- For Developers & EPCs: A capital lease is frequently the superior choice for maximizing upfront tax deductions on large projects. By structuring the agreement to meet an IRS criterion, you unlock tools like the Section 179 deduction, which can drastically lower current-year tax liability and improve project cash flow.

When analyzing the financial side of equipment acquisition, understanding the bigger picture of how to implement lease vs buy company vehicles can be helpful. This fundamental choice often dictates which type of lease makes the most sense. Always consult your tax advisor to ensure your lease agreement aligns with your overall financial goals.

Understanding Bonus Depreciation and Interest Limits

Recent U.S. tax law changes have significantly impacted equipment financing. Two rules are now front-and-center for financial controllers and project managers: bonus depreciation and the Section 163(j) business interest expense limitation. Understanding how these interact is critical for making smart financial decisions.

On the surface, bonus depreciation makes buying equipment outright look very attractive. It allows a business to deduct a large percentage of a new or used asset's cost in the first year it’s placed in service.

But there’s a catch. Section 163(j) now puts a strict cap on how much business interest expense you can deduct from your taxable income. For many companies, this significantly reduces the financial benefit of taking out a traditional loan to buy equipment.

The Critical Difference for Leases

This is where the tax benefits of equipment leasing, especially for capital-heavy industries, truly shine. While interest paid on a loan is subject to the Section 163(j) limit, the payments on a true operating lease are not.

Those lease payments are typically treated as a standard operating expense. This means they are 100% deductible without being limited by the interest expense cap, delivering a more reliable—and often larger—tax advantage.

The Tax Cuts and Jobs Act (TCJA) of 2017 introduced both enhanced bonus depreciation and tougher interest limits. While bonus depreciation initially spurred equipment purchases, the interest cap has pushed many businesses back toward leasing. This became even more relevant in 2022 when the interest deduction calculation became stricter. The bottom line: true lease payments remain fully deductible, neatly sidestepping the interest limitation issue.

Why This Matters for Procurement and Project Bids

For procurement managers and EPCs, understanding this distinction is a powerful strategic tool. When weighing financing options for a large project—like solar arrays, backup generators, or commercial HVAC systems—the after-tax cost is what truly matters.

Let’s break it down:

- Loan Financing: You might get a large depreciation deduction upfront, but your interest deduction could be limited, raising your overall tax bill.

- Operating Lease: You get a steady, predictable, and fully deductible expense every month. This simplifies accounting and provides tax certainty.

This insight can make your project bids more competitive and protect your company's bottom line from unexpected tax liabilities. By opting for an operating lease, you ensure your financing strategy is as efficient as your operations. To stay on top of similar topics, feel free to explore our other expert articles on the Portlandia Electric Supply blog.

Expert Tip for Financial Controllers: Before committing to a large equipment purchase with a loan, model the real impact of the Section 163(j) interest limitation on your projected taxable income. You'll often find that the uncapped, fully deductible payments of a true lease result in a superior after-tax outcome.

The Power of Deductible Lease Payments

One of the cleanest and most immediate tax advantages of leasing is how you handle the payments. With a true operating lease, every payment is treated as a simple operating expense—the same as rent or utilities. This means you can deduct 100% of your lease payments directly from your business income.

This is fundamentally different from a traditional loan. When you finance equipment, your monthly payment is split into principal and interest. You can only write off the interest portion of that payment, not the principal that pays down the asset. It's a critical distinction that has a huge effect on the real, after-tax cost of acquiring assets.

The Financial Advantage of Simplicity

For any business owner or financial controller, the real beauty of an operating lease is its predictability. Forget tracking separate interest and principal amounts or wrestling with complex depreciation schedules. Instead, you have one straightforward, fully deductible expense. This cleans up your books and makes financial forecasting significantly easier.

This direct approach delivers two key wins:

- Better Cash Flow: By deducting the entire payment, you lower your taxable income more effectively than with a loan. That means more cash stays in your business every month.

- Tax Certainty: There are no surprises. You know exactly what your deduction will be for every payment period, allowing for more dependable tax planning.

A Clearer Path to Lowering Your Tax Bill

The case for fully deductible lease payments became even stronger after recent tax reforms. Changes in tax law expanded the deductibility of equipment costs, boosting cash flow and tax efficiency. The 2018 tax reform opened the door for 100% bonus expensing of new and used equipment in the first year.

While that sounds great, it came with the interest deduction limits we discussed earlier. As a result, many businesses now find that operating leases offer a much clearer path to tax savings, since the payments are 100% deductible without the same limitations. For more on this, you can find great insights into how equipment financing benefits taxes at cnb.com.

The Bottom Line: A true operating lease transforms a massive capital purchase into a simple, fully deductible operating expense. It provides a direct, dollar-for-dollar reduction in your taxable income. For project-based businesses focused on cash flow and budget certainty, this is the most compelling financial reason leasing often beats buying.

Common Questions About Leasing and Taxes

Once you dig into the tax benefits of equipment leasing, practical questions arise. Here are answers to common queries we hear from clients, designed to help your procurement team make confident decisions and avoid leaving money on the table.

Can I Deduct Sales Tax and Delivery Fees on Leased Equipment?

Yes, but how you deduct them depends on your lease structure.

With a capital lease where you plan to take the Section 179 deduction, you can bundle all costs needed to get the equipment operational—sales tax, delivery fees, and installation charges—into the total financed amount. The entire sum then becomes eligible for the immediate Section 179 write-off, up to IRS limits.

With a true operating lease, these costs are typically baked into your regular monthly payment. Since you're deducting the entire monthly payment as a standard business expense, you're effectively writing off the sales tax and delivery fees over the life of the lease.

What Is the Difference Between a True Lease and a Capital Lease for Tax Purposes?

The core difference is how the IRS views the transaction: are you renting or are you buying? This distinction completely changes your available tax benefits.

A "True Lease," or operating lease, is treated as a rental for tax purposes. You deduct your full monthly lease payments as a business expense. The equipment does not appear on your balance sheet as an asset.

A "Capital Lease," or finance lease, is treated as a purchase. The asset is recorded on your balance sheet, and instead of deducting payments, you take depreciation deductions—including the powerful Section 179 write-off, if applicable. The IRS uses specific tests (like the $1 buyout option) to classify the lease.

Guidance by ICP:

- For Installers: The simplicity of an operating lease is often best. It avoids complex accounting and provides a clear, deductible monthly cost.

- For Developers/EPCs: A capital lease can be a strategic tool to maximize immediate tax write-offs on large capital expenditures, improving project-level ROI.

How Do I Ensure My Lease Is Structured Correctly for Tax Benefits?

Getting the desired tax treatment from your lease requires careful planning and communication.

First, always have your accountant or tax advisor review the lease agreement before signing. They are the only ones who can confirm the contract is structured to qualify for either the Section 179 deduction (capital lease) or the simple operating expense deduction (operating lease).

Second, work with a reputable equipment financing partner who understands how to structure an Equipment Finance Agreement (EFA) or capital lease to meet specific tax goals. Clear communication between you, your accountant, and your financing company is the best way to ensure the lease aligns perfectly with your tax strategy. While these specifics are key, it also helps to have a handle on your broader tax picture. You can find some general guidance on handling small business and personal taxes to round out your knowledge.

These topics can be dense, but mastering the rules is essential for maximizing the financial advantage of your equipment decisions. For more discussions on related topics, feel free to explore our uncategorized blog section.

At Portlandia Electric Supply, we provide the equipment and the expertise to help you make the smartest financial decisions for your projects. As a real project partner, we offer transparent pricing, bundled logistics, and full compliance support to help you navigate everything from bulk material sourcing to financing. Request a Quote today to see how our in-stock inventory and rapid quoting can optimize your next project.