Industrial Solar Panels: A Buyer's Guide for EPCs, Developers, and Facility Managers

Industrial solar panels are strategic assets, purpose-built for high-output, durability, and financial performance. For EPCs, developers, and facility managers, specifying the right panels and managing the project execution is how you deliver real-world results: slashing operational costs, meeting compliance mandates, and insulating your business against volatile grid prices. This guide provides a decision-making framework for selecting, procuring, and deploying industrial-scale solar to maximize project ROI.

Why Industrial Solar Panels Are a Strategic Decision

For anyone making decisions on a large-scale project—whether you're an EPC, a developer, or a facility manager—specifying industrial solar panels has moved beyond an environmental checkbox. It's now a critical business decision driven by new regulations, supply chain realities, and intense cost pressures.

These panels aren't just bigger versions of residential modules. They are complete systems designed for one thing: maximum power generation and financial performance under tough commercial conditions. This strategic shift is a direct answer to real-world operational headaches, with cost control being the primary driver. By generating power on-site, you insulate your budget from unpredictable rate hikes and demand charges that erode profitability.

Tangible Outcomes for Project Decision-Makers

The strategic wins are clear and measurable across different roles. For a facility manager, a large, empty rooftop becomes a power plant that crushes operational expenses. For a project developer, it means creating a more valuable, resilient asset that attracts tenants and meets sustainability goals.

The primary outcomes include:

- Slash Operational Costs: On-site solar generation directly reduces utility purchases, delivering immediate savings and budget certainty in a volatile expense category.

- Achieve ESG and Corporate Mandates: A commercial solar installation is a highly visible, impactful way to meet environmental, social, and governance (ESG) targets demanded by investors, customers, and regulators.

- Build Energy Resilience: An industrial solar array, especially when paired with battery storage from brands like BYD or FranklinWH, provides reliable backup power, ensuring critical operations continue during grid outages.

- Capitalize on Financial Incentives: Federal programs like the Investment Tax Credit (ITC) and MACRS depreciation make solar an incredibly attractive investment. The Inflation Reduction Act (IRA) offers lucrative adders for projects using domestic content or built in specific energy communities, dramatically improving ROI.

Expert Tip for Procurement Managers: Don't focus solely on the upfront cost-per-watt. The critical metric is the Levelized Cost of Energy (LCOE), which accounts for lifetime energy production, degradation, and O&M costs. A panel with higher efficiency and a lower degradation rate, even with a higher initial cost, will deliver a superior long-term return.

Choosing industrial solar is a forward-thinking move to future-proof your operations. By working with a knowledgeable project partner like Portlandia Electric Supply, you can cut through the complexities of procurement, logistics, and compliance to ensure your project delivers maximum strategic value.

Decoding Industrial Solar Panel Technology

For project decision-makers, a spec sheet for industrial solar panels can look like a different language. Terms like temperature coefficient and degradation rate aren’t just technical fluff—they directly plug into your project's financial model. Understanding these specifications is what separates a smart procurement from a costly guess, ensuring you achieve the forecasted performance and ROI.

Core Panel Technologies Explained

For any serious commercial, industrial, or utility-scale project, the decision usually comes down to three main types of crystalline silicon panels.

- Monocrystalline Panels: These are the high-performance engines of the solar world, made from a single, pure silicon crystal. This structure provides the highest efficiency ratings, making them ideal for projects where space is limited and maximizing energy density is critical.

- Polycrystalline Panels: Built by melting multiple silicon fragments together, these panels are a more cost-effective option. The trade-off is lower efficiency due to grain boundaries that impede electron flow. They are a solid choice for large-scale ground-mount projects where ample space is available and a lower upfront cost-per-watt is the priority.

- Thin-Film Panels: This category involves applying a super-thin photovoltaic layer to a substrate. While typically less efficient than crystalline silicon, they can offer better performance in high-temperature and low-light conditions. Their light weight and flexibility also open up applications where standard rigid panels are not feasible.

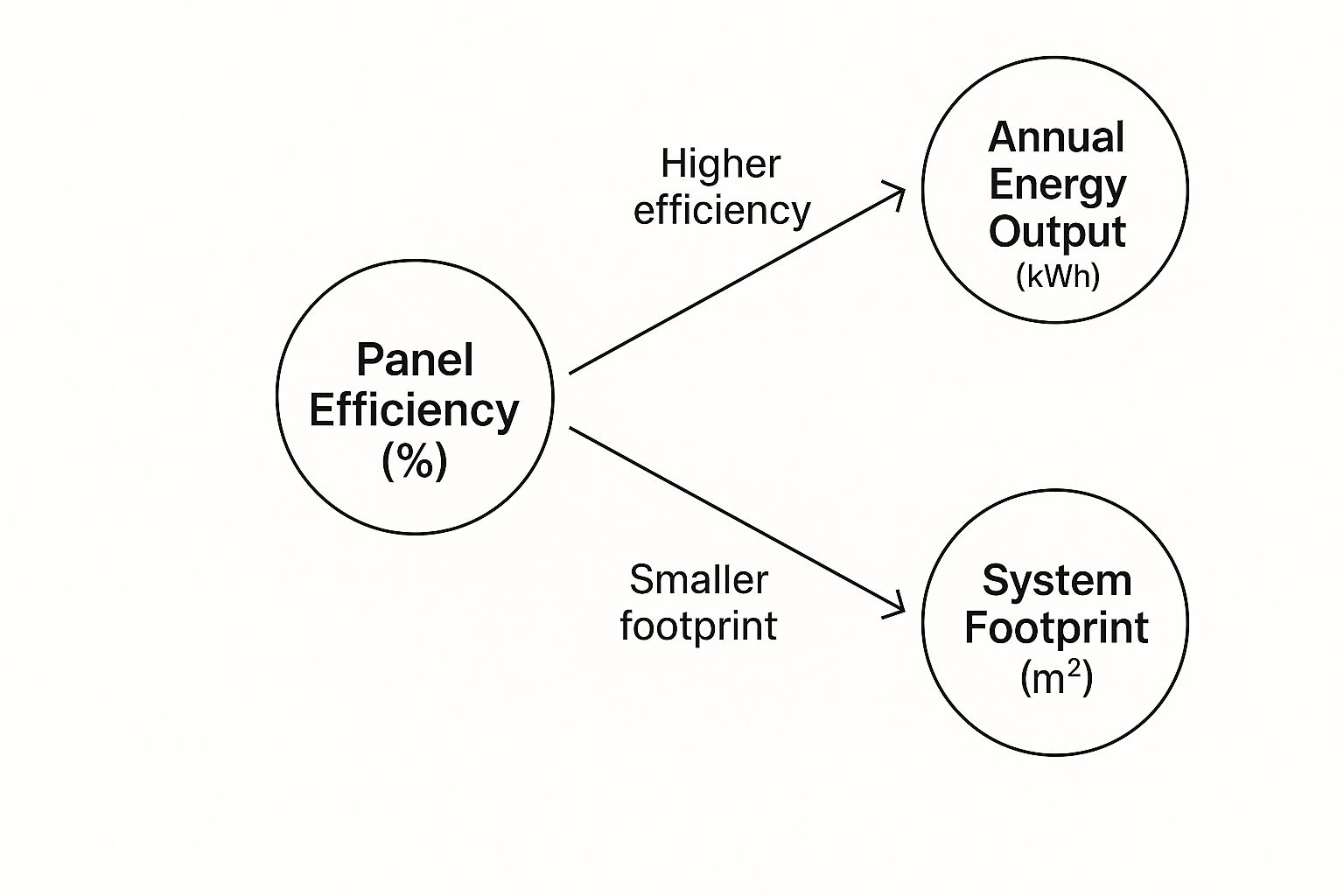

Critical Mistake to Avoid: A 1% difference in panel efficiency might seem minor, but for a 1 MW project, it can translate to thousands of extra kilowatt-hours generated annually. This is real revenue that directly impacts your bottom line, especially in markets with performance-based incentives.

As this graphic shows, higher efficiency delivers more power from the same footprint, allowing you to either maximize generation on a constrained site or achieve energy targets with a smaller, more economical system.

Comparing Key Technologies for Industrial Solar Panels

Here’s a practical breakdown of how these technologies stack up for industrial-scale projects.

| Technology Type | Typical Efficiency | Cost Profile | Best For (Use Case) | Critical Weakness |

|---|---|---|---|---|

| Monocrystalline | 18% - 23% | High | Rooftop C&I projects; space-constrained sites | Higher upfront cost per panel |

| Polycrystalline | 16% - 19% | Medium | Large ground-mount utility farms; budget-driven jobs | Lower efficiency requires more physical space |

| Thin-Film | 10% - 16% | Low-Medium | High-temperature climates; architectural integration | Lowest efficiency; requires largest footprint |

Ultimately, the "best" panel is the one that best fits your project's specific location, budget, and performance targets.

Translating Specs into Project Impact

A spec sheet is full of numbers, but only a few truly drive your project's financial success.

- Temperature Coefficient: This metric quantifies power loss as temperatures rise above 25°C (77°F). On a hot commercial roof, a panel with a poor rating (e.g., -0.35%/°C) will produce significantly less energy than one with a better rating (e.g., -0.29%/°C). This difference directly impacts summer revenue.

- Degradation Rate: This is your crystal ball for long-term financial modeling. A Tier 1 panel might guarantee its output will not drop below 85% of its nameplate rating after 25 years. A cheaper panel may degrade faster, eroding your project's IRR and NPV over its lifespan. For example, our review of Philadelphia Solar's 440W modules highlights modules engineered for extremely low degradation.

- Durability Ratings (Wind/Snow/Hail): These certifications (e.g., UL, IEC) are not just for insurance; they are direct indicators of build quality and the panel's ability to withstand real-world site conditions for decades, ensuring long-term project viability.

Navigating the Solar Supply Chain and Market

For developers, EPCs, and procurement managers, project success is dictated by your understanding of the market. The timeline and profitability of your project are directly tied to the complex web of global and U.S. solar supply chains. It’s a world full of variables, where international manufacturing capacity, pricing volatility, and trade policies create both huge risks and golden opportunities.

Understanding Global Market Dynamics

The market for industrial solar panels is global, and a ripple on the other side of the world can create a wave of cost changes for U.S. projects. In 2023, global module production capacity massively outpaced demand, creating a stockpile that sent prices tumbling. You can get a clearer picture of these trends by exploring detailed market snapshots.

For a U.S. buyer, this volatility presents two scenarios:

- Opportunity: When prices dip due to a global glut, it’s a chance to lock in modules at a favorable cost-per-watt, boosting project ROI.

- Risk: Sudden production cuts or new trade policies can cause prices to spike without warning, blowing up a budget built on yesterday's costs.

-

Pro Tip for Procurement: When you spot favorable pricing, work with a distribution partner like Portlandia Electric Supply to secure that inventory. Our PowerLink platform and nationwide warehousing allow you to lock in prices and

- omestic factories for panels, inverters, and racking. This isn't just about patriotism—it’s about building a more stable, predictable supply chain.

- This domestic boom changes the procurement game:

- IRA Compliance: To capture the lucrative 10% domestic content tax credit "adder," you must use U.S.-made components. A distributor who can source and certify these products is essential.

- Reduced Lead Times: Sourcing domestically can slash delivery timelines and mitigate risks from international shipping and port congestion.

- Tariff Mitigation: Using American-made panels shields your project from the financial risks of tariffs and trade disputes on imported goods.

- Navigating this new landscape requires knowing which manufacturers are producing IRA-compliant products. Solving this puzzle unlocks major financial and logistical wins for your portfolio of solar energy solutions.

- A Framework For Selecting The Right Solar Panels

- Choosing the right industrial solar panels is the single most important decision for a project's financial returns and long-term performance. For any engineer, procurement officer, or project manager, the work is to get past marketing claims and use a structured approach to de-risk the investment. This means systematically vetting manufacturers, warranties, compliance, and technology fit for your specific site.

- Procurement Checklist: A Step-by-Step Guide

-

store materials until your job site is ready, insulating you from market volatility.

- The Rise of U.S. Solar Manufacturing

- The most significant trend for U.S. projects is the onshoring of solar manufacturing, driven by the Inflation Reduction Act (IRA). Billions are being invested in new d

-

Start With Manufacturer Bankability (Tier 1 Status):

Before analyzing specs, verify the manufacturer's stability. The "Tier 1" classification from sources like BloombergNEF is not a quality rating but a measure of financial health. For any large-scale project, specifying a Tier 1 manufacturer (like Trina Solar, Jinko Solar, or Canadian Solar) is a non-negotiable risk management step. It ensures the 25-year performance warranty is backed by a company that will be around to honor it. -

Analyze Warranties: Product vs. Performance:

Every panel has two distinct warranties:- Product Warranty: Covers defects in materials and workmanship, typically for 12-15 years (some premium brands offer 25). This is your insurance against physical failure.

- Performance Warranty: Guarantees a minimum power output over 25-30 years, setting a cap on annual degradation. A stronger performance warranty directly translates to more kilowatt-hours and a higher project IRR. For a deeper dive, see our guide on the best solar panel brands.

-

Verify Compliance and Certifications:

Certifications are non-negotiable proof that a panel meets U.S. safety and performance standards. Your checklist must include:- UL 61730: The primary safety standard for PV modules in North America. No UL mark, no legal installation.

- IEC 61215: The international standard for design quality and environmental stress testing.

- Environmental Ratings: For specialized sites, verify salt mist resistance (IEC 61701) for coastal projects or ammonia resistance (IEC 62716) for agricultural applications.

-

Match Panel Specs to the Project Environment:

Finally, match technical specs to site conditions. For a space-constrained rooftop, a high-efficiency monocrystalline panel maximizes output. For a large ground-mount, a cost-effective polycrystalline panel might yield a better LCOE. Pay close attention to temperature coefficient for hot climates and wind/snow load ratings for harsh weather zones.

- Working with a supplier like Portlandia Electric Supply streamlines this process by providing fully certified components and the necessary documentation to ensure your project passes permitting and inspection without delays.

- Managing Logistics for Large-Scale Solar Projects

- Selecting the best industrial solar panels is only half the battle. Now comes the operational execution: getting every pallet, inverter, and bolt from the warehouse to the job site on time and in perfect condition. For EPCs and project managers, this is where timelines are met or blown, and unforeseen costs can cripple a budget. A solid logistics plan is your primary defense against expensive delays, damaged equipment, and idle crews.

- On-Site Material Handling and Inventory Staging

- A chaotic job site is not just inefficient—it’s a safety and financial risk. A well-designed staging plan is crucial.

-

Pro Tip for Facility Managers & EPCs: Before the first truck arrives, designate secure, accessible laydown areas. Stage panels near the installation point to minimize handling. Keep sensitive electronics like inverters from brands like Sungrow or Fronius in a protected, dry location. This simple step saves thousands in replacement costs and keeps crews productive.

- A seamless workflow involves:

- Inventory Verification: Immediately check the bill of lading against your purchase order upon delivery. Catching a discrepancy on day one prevents a critical-path delay weeks later.

- Sequential Staging: Arrange components in installation order: racking first, then panels, followed by wiring and electrical gear. This prevents crews from wasting time searching for parts.

- Protection from Elements: Ensure all components, especially modules and electronics, are covered and secured against weather.

- Installation and System Design Considerations

- The physical installation is where logistical planning pays off. The system's design, particularly the mounting choice, impacts both logistics and long-term energy output.

- Fixed-Tilt vs. Tracker Mounting

| Mounting System | Best For | Key Consideration |

|---|---|---|

| Fixed-Tilt | Rooftop projects, high-wind areas, and budget-conscious builds. | Simpler logistics and lower maintenance, but generates less energy per panel. |

| Trackers | Large ground-mounts, maximizing energy output (yield can increase 15-25%). | More complex logistics, higher upfront costs, and requires ongoing O&M. |

- Wiring strategy must be designed for peak efficiency and NEC (National Electrical Code) compliance. Proper wire management, combiner box placement, and string sizing are critical to minimize voltage drop and pass inspection.

- This is where a distribution partner with technical expertise and robust logistical support becomes a force multiplier. At Portlandia Electric Supply, we offer bundled freight, kitting, and access to nationwide hubs to de-risk this entire phase, ensuring a predictable flow of materials to keep your project on schedule and on budget.

- Maximizing Your Solar Project ROI

- For any CFO, developer, or asset owner, the measure of a solar project is what shows up on the balance sheet. A strategic investment requires squeezing every ounce of financial return from the system. This means looking past simple payback and mastering the financial metrics that define profitability: Levelized Cost of Energy (LCOE), Internal Rate of Return (IRR), and Net Present Value (NPV).

- Capturing Every Available Incentive

- The key to an unbeatable ROI is capturing every dollar from federal, state, and utility incentives.

- Investment Tax Credit (ITC): The foundation of solar finance, allowing a direct deduction of a large percentage of project costs from federal taxes.

- MACRS Depreciation: The Modified Accelerated Cost Recovery System lets you accelerate asset depreciation, creating a powerful tax shield in the project's early years.

- IRA Adders: The Inflation Reduction Act (IRA) supercharged the ITC with bonus credits that can transform project economics but require strict compliance.

-

For Developers and Asset Owners: A 10% bonus for domestic content or another 10% for siting a project in an "energy community" can be the deciding factor for project viability. This is why partnering with a distributor like Portlandia Electric Supply, who can source and document IRA-compliant materials, is critical.

- The Role of Compliance in Financial Success

- These incentives are earned through diligent documentation. One slip-up in sourcing or paperwork can put millions in tax credits at risk. Meticulous record-keeping is not optional; it is a core project requirement. An experienced partner helps you navigate changing Treasury Department rules and provides the certifications needed to de-risk your investment and capture every financial benefit.

- Market Outlook and Resilience

- The financial case for industrial solar is strengthening. The U.S. now has over 163 gigawatts of installed solar capacity. Despite fluctuations, the commercial and industrial sectors remain robust. 38% of solar companies expect business growth, and another 35% anticipate stable sales. You can explore more insights into the U.S. solar market for a deeper dive. This resilience, fueled by the IRA, proves the long-term value of industrial solar as a high-performing financial asset.

- Industrial Solar Project FAQs

- Here are straightforward answers to common questions from EPCs, developers, and facility managers about industrial solar panels.

- What Is the Real Difference Between Tier 1 and Tier 2 Panels?

- "Tier 1" is not a quality rating; it's a ranking of a manufacturer's financial health and bankability. Tier 1 companies are large, established, and vertically integrated, making them a low-risk bet for financiers. While their quality is often excellent, a premium Tier 2 panel could potentially outperform a budget Tier 1 module.

-

The Bottom Line for Developers: Specifying Tier 1 is a risk management strategy to ensure the 25-year performance warranty will be honored. The final decision should balance this bankability against specific project performance targets and budget.

- How Do I Qualify for the IRA Domestic Content Bonus?

- To secure the extra 10% IRA domestic content bonus, you must prove a specific percentage of your project's total manufactured component costs are from U.S. sources. This calculation includes not just panels but also inverters, racking, and wiring. Partnering with a supplier like Portlandia Electric Supply is key to sourcing compliant components and obtaining the bulletproof documentation needed to claim the credit.

- What Are the Biggest Hidden Costs in Industrial Solar?

- Budget-breaking surprises often appear in three areas:

- Logistics: The cost of freight for oversized panel pallets and other equipment is a significant, often underestimated expense.

- Interconnection: Utilities may require expensive grid studies or system upgrades, adding major costs and long delays.

- Structural Surprises: An older commercial building roof may require costly reinforcements to support the array's weight.

-

Critical Mistake to Avoid: Don't skip the upfront due diligence. A thorough site assessment, a professional structural analysis, and a detailed logistics plan from an experienced partner are your best defense against these hidden costs.

- Ready to de-risk your next project with transparent pricing, IRA-compliant materials, and optimized logistics? The experts at Portlandia Electric Supply can build a custom quote based on your exact project needs. Request a Quote Today!