Solar Panel Tier 1: What It Is & Why It Matters for Your Project

Share

For solar installers, EPCs, developers, and procurement officers, the term Tier 1 solar panel is a critical financial signal, not a quality rating. This guide cuts through the confusion to explain precisely what Tier 1 means for project bankability, risk management, and supply chain reliability. By the end, you will have a clear decision-making framework to select the right panels, whether you're sourcing for a utility-scale farm, a commercial rooftop, or a residential build.

Think of Tier 1 less as a product spec and more as a financial health score for the manufacturer. It's a signal that the company is a stable, long-term player capable of backing up its warranties and supplying massive solar projects without fail.

Decoding the Tier 1 Solar Panel Ranking

When you see "Tier 1," don't look for a sticker on the panel. This ranking isn't about physical specs like efficiency or degradation. Instead, it’s a classification maintained by financial analysis firms, most notably BloombergNEF (BNEF). Their focus is purely on a manufacturer's bankability.

So, what does that actually mean for you on the ground? It's a measure of how likely a manufacturer is to be a reliable, financially sound partner for the long haul—critical for securing financing and honoring 25-year warranties.

What Bankability Really Means

At its core, bankability is the litmus test for the Tier 1 designation. For a manufacturer to make the list, they have to prove their panels have been used in at least six different, large-scale (1.5 MW+) solar projects over the last two years.

But here’s the key: those projects must have been financed by six different banks without recourse. This means major financial institutions have put their own money on the line, betting that the manufacturer’s products are a safe investment for multi-million dollar energy deals.

This vetting process confirms that a Tier 1 manufacturer isn't just making good panels; they're also a solid business. Specifically, they are:

- Financially Stable: They have a strong balance sheet and are expected to be around for the next 25 years to honor those warranties.

- Vertically Integrated: Most Tier 1 companies control their entire manufacturing process, from silicon to the final module. This ensures tight quality control and a much more stable supply chain.

- Proven at Scale: They have a documented history of supplying huge utility-scale projects, proving they can handle massive orders reliably.

The Tier 1 classification has become a go-to indicator of a manufacturer's stability and production muscle. This is precisely why investors, developers, and financiers put so much stock in it—it’s about minimizing risk and ensuring the long-term viability of their solar assets. You can find out more about 2025 manufacturer rankings and what they mean for your projects to see who makes the cut.

Tier 1 vs Technical Specs At a Glance

It's easy to confuse a manufacturer's financial rating with a panel's performance data sheet. This table breaks down the difference, helping you focus on the right metrics for the right reasons.

| Factor | What It Indicates | Primary User Concern |

|---|---|---|

| Tier 1 Ranking | The manufacturer's financial health, stability, and history of supplying large-scale, bank-financed projects. | Will the manufacturer be in business to honor a 25-year warranty? Is this brand a safe bet for a multi-million dollar project? |

| Technical Specs | The panel's actual performance characteristics, such as efficiency (%), power output (watts), and degradation rate. | How much energy will this panel produce? How will it perform in low light or high heat? How much power will it lose over time? |

Ultimately, a Tier 1 ranking gives you confidence in the company, while the technical spec sheet tells you what the product can actually do. For any serious project, you need both.

What Tier 1 Status Means for Your Solar Project

We've established that the Tier 1 solar panel ranking is all about a company's financial stability. But what does that actually mean for a real-world project? Why should a developer, installer, or financier care?

This isn't just an abstract Wall Street metric. For professionals on the ground, "bankability" is the make-or-break factor that determines if a project gets funded or dies on the vine.

Picture this: a developer walks into a bank with a proposal for a new utility-scale solar farm. If that proposal specifies panels from established Tier 1 brands like Sungrow or BYD, it immediately signals lower risk to the lenders. They’ve seen these names succeed time and time again.

The result? Securing financing is suddenly much, much easier. We're not just talking about getting a "yes"—we're talking better interest rates and a faster, smoother approval process that can shave weeks or even months off the project timeline.

Playing the Long Game: Mitigating Risk

For installers and EPCs, the true value of working with a Tier 1 manufacturer often doesn't show up until years after the last bolt is tightened.

Every solar panel comes with two crucial warranties: a product warranty (usually 12-25 years) covering defects and a performance warranty (25-30 years) guaranteeing a certain level of output. But let's be blunt: a warranty is only as strong as the company that writes it.

Choosing a Tier 1 manufacturer gives you real confidence that the company will still be around in 15 or 25 years to honor a claim. This is huge. It protects your own reputation and saves you from footing the bill to replace failed equipment for a client down the road.

Critical Note for Procurement Officers: Specifying Tier 1 panels isn't just a line item on a purchase order; it's a core risk management strategy. Underwriters recognize the lower chance of component failure and manufacturer bankruptcy, which can lead directly to lower insurance premiums for the project. That’s a direct impact on the long-term operational budget and project ROI.

Keeping the Supply Chain Strong for Big Jobs

Beyond the financial and warranty aspects, Tier 1 status brings immediate logistical muscle, which is absolutely critical for large-scale deployments. These companies operate on another level, with massive, vertically integrated manufacturing and sophisticated global supply chains.

This scale provides a few key advantages you can't ignore:

- Product on Deck: Need thousands of modules on a tight deadline? Tier 1 manufacturers have the production capacity to fill huge orders without breaking a sweat.

- Logistical Certainty: They have dialed-in distribution networks, like the ones we rely on at Portlandia Electric Supply, ensuring panels show up when they're supposed to. No more costly downtime waiting for a truck.

- Less Market Volatility: Their financial heft means they can better navigate supply chain hiccups than smaller players, keeping your project pipeline flowing smoothly.

At the end of the day, picking a Tier 1 solar panel isn't about chasing a label. It's a strategic business decision that shores up your financing, guarantees long-term performance, and builds a supply chain tough enough for any job you throw at it.

Comparing Tier 1 vs Tier 2 and Tier 3 Panels

Choosing the right solar panel tier isn't just about picking the "best" product. It’s about matching the panel's financial DNA to your project's specific needs, from lender requirements to your own risk tolerance.

For developers and EPCs in the big leagues, the conversation almost always starts and ends with bankability. Tier 1 solar panels are the gold standard for utility-scale projects or any client who needs absolute certainty and a smooth path to financing. Lenders see these big-name brands as de-risked assets, which makes getting the money a whole lot easier.

But Tier 2 and Tier 3 panels bring their own arguments to the table, usually centered on a trade-off between upfront cost, perceived risk, and technology.

Differentiating the Tiers for Your Project

So, what’s the real difference on the ground?

Tier 2 solar panels come from solid, established manufacturers who just aren't at the massive scale of the Tier 1 giants. They can be a fantastic value for commercial or residential jobs where the financing isn't quite as strict. If your project has flexible capital or the client is laser-focused on day-one savings, Tier 2 is a perfectly good road to take.

Tier 3 solar panels are the wild west. This group is a mix of everyone else: new players, smaller assembly shops, and companies focused on niche products. They definitely carry more risk in the long run, but they might offer a unique technology or a price that’s too good to ignore for a small, cash-funded project where the owner is willing to roll the dice on the warranty.

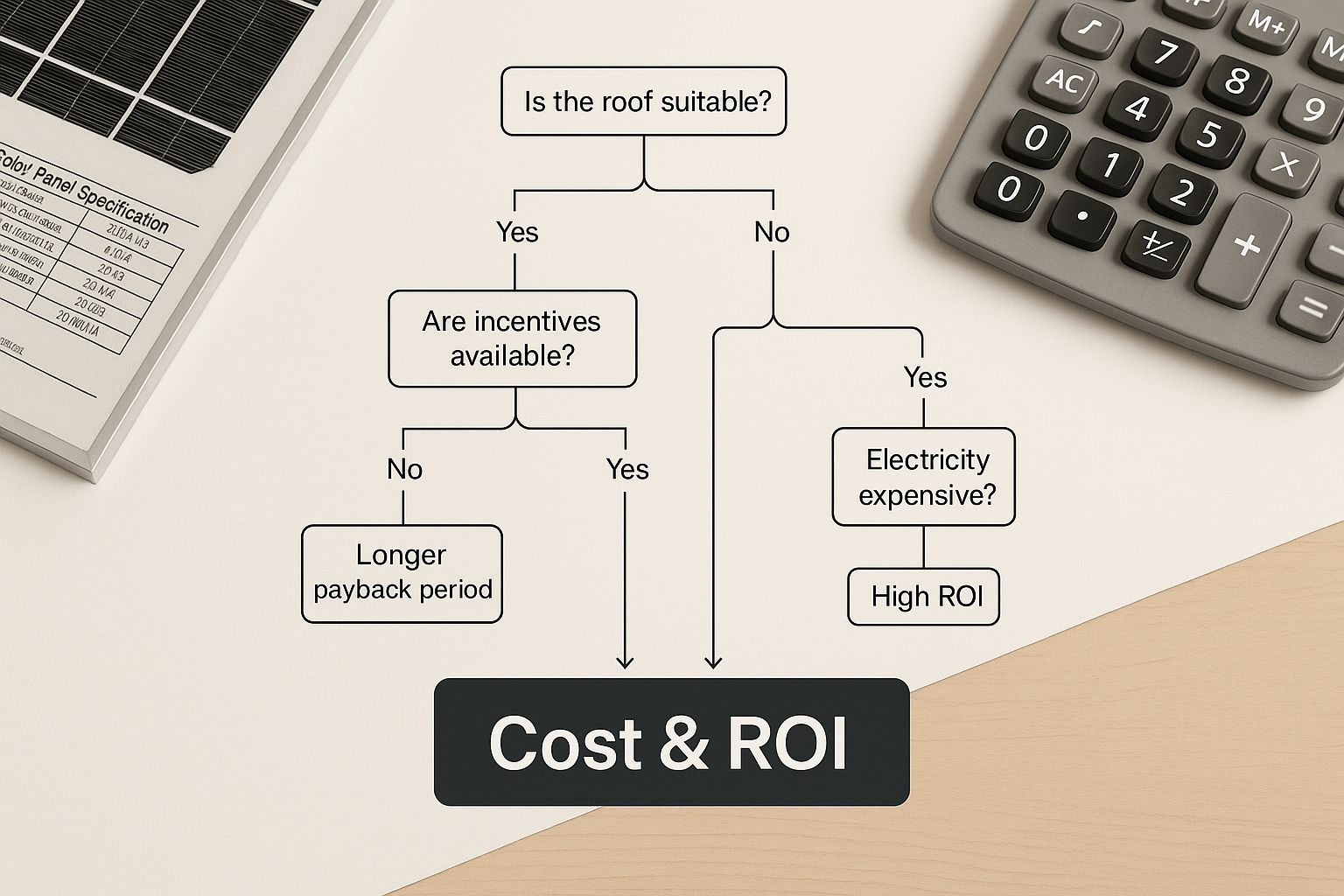

This graphic really breaks down how cost and ROI play out across the different tiers.

The takeaway is pretty clear: while Tier 1 panels cost more upfront, their rock-solid bankability and reliable warranties usually deliver a more secure long-term return. This is especially true for any project that involves a loan.

Decision Matrix: Tier 1 vs Tier 2 vs Tier 3 Panels

To make this even more practical, here is a decision matrix to help installers and developers quickly weigh the pros and cons based on what really matters for their specific job.

| Attribute | Tier 1 | Tier 2 | Tier 3 |

|---|---|---|---|

| Bankability | Excellent. Preferred by all major lenders for non-recourse project finance. | Good. Often acceptable for regional banks and smaller commercial loans. | Low to none. Difficult to finance; typically for cash-only deals. |

| Warranty | 25-30 year performance and product warranties, backed by a stable company. | Variable, often 15-25 years. Company longevity is a key consideration. | Typically 10-15 years. Warranty claims can be a major risk. |

| Upfront Cost | Highest. Premium pricing for proven reliability and bankability. | Moderate. A balance of cost and proven manufacturing. | Lowest. High potential for upfront savings. |

| Ideal Project | Utility-scale, large commercial, financed residential. Any project requiring third-party financing. | Mid-sized commercial, residential, some off-grid. | Small, cash-funded projects, DIY, non-critical applications. |

| Risk Profile | Low. Minimal risk of manufacturer failure or unsupported warranty claims. | Moderate. Requires due diligence on the manufacturer's history and financial health. | High. Significant risk of panel failure and unsupported warranties. |

Ultimately, this matrix highlights the core trade-off: Tier 1 offers security at a premium, while lower tiers provide cost savings but require you to take on more of the long-term risk yourself.

A Practical Decision-Making Framework

To cut right to the chase, here’s a step-by-step checklist to guide your selection process with clients, bankers, and your own team.

-

Step 1: Define Project Financing. Is this a cash deal or does it require a loan?

- If financed: Tier 1 is almost always mandatory. Don't waste time on other options.

- If cash: Proceed to Step 2.

-

Step 2: Assess Client Risk Tolerance. Is the client focused on minimizing long-term risk or maximizing upfront savings?

- Low Risk Tolerance (e.g., commercial property owner): Stick with Tier 1 for warranty assurance.

- High Risk Tolerance (e.g., DIY off-grid cabin): Tier 2 or even Tier 3 can be considered.

-

Step 3: Evaluate Project Scale.

- Utility-Scale and Large Commercial: Tier 1 is the only game in town for supply chain reliability and bankability.

- Mid-Sized Commercial & Residential: Tier 1 is the safest bet, but a well-vetted Tier 2 brand can be a viable alternative for cash projects.

If you’re ready to look at specific brands, our guide on the best Tier 1 solar panels of 2025 gets into the nitty-gritty with performance data and head-to-head comparisons to help you lock in the right module.

How the Top Tier 1 Solar Manufacturers Operate

To really grasp why a solar panel tier 1 designation carries so much weight, you need to look at how the biggest names in the business operate. Market leaders like Jinko Solar, JA Solar, and LONGi aren’t just stamping out panels; they’re running massive, fine-tuned global operations built for scale, relentless innovation, and long-term market control.

For anyone in procurement, understanding their playbook gives you a huge advantage. It tells you what’s really driving panel costs, availability, and the tech inside them. You’re not just buying a product; you’re tapping into a whole ecosystem.

Vertical Integration and Economies of Scale

A cornerstone strategy for nearly every Tier 1 player is vertical integration. In simple terms, they own the entire assembly line—from processing raw silicon into ingots and wafers, to building the cells, to assembling the final modules. This complete control gives them some serious firepower.

- Ironclad Quality Control: Managing every step means they can enforce brutally strict quality standards. This is how they minimize defects and ensure every panel is as good as the last, even when producing millions.

- Supply Chain Dominance: They're far less exposed to supplier hiccups or shortages, which means a steadier, more predictable production flow.

- Cost Management: When you own the whole process, you can squeeze out inefficiencies and manage costs with precision—an absolute must in an industry with razor-thin margins.

This operational grip is what allows for mind-boggling economies of scale. In 2024, the top 10 manufacturers shipped an incredible 500 gigawatts (GW) of modules. Powerhouses like Jinko Solar (90.6 GW), JA Solar (89.8 GW), and LONGi (86.5 GW) led the pack.

But this scale comes at a cost. Despite those massive shipment numbers, fierce price wars and huge capital investments resulted in collective losses of around $4 billion. It’s a high-stakes game where only the biggest can survive. You can dig deeper into the intense market dynamics in the 2025 solar manufacturer rankings.

Aggressive Investment in Research and Development

Staying at the top isn't a one-time thing; it requires constant forward motion. Tier 1 manufacturers pour hundreds of millions into research and development (R&D) to keep their technology ahead of the curve. They are relentlessly pushing the envelope on next-gen cell tech like TOPCon and HJT to boost efficiency and drive down the levelized cost of energy (LCOE).

Expert Tip for Developers: When you’re vetting Tier 1 manufacturers, check their R&D spend as a percentage of revenue. A higher number is a strong signal that they’re committed to future-proofing their tech, which means better long-term performance and bankability for your projects.

This obsession with R&D is precisely why specifying a Tier 1 panel gets you access to the latest and greatest technology on the market. It’s also why their modules are the default choice for performance-critical utility and commercial projects. Their financial stability is what funds the very innovation that keeps them on top.

How to Select Panels Beyond the Tier 1 Label

The solar panel tier 1 label is a great first filter. It helps you quickly build a shortlist of reputable companies, but that's all it is—a starting point. For any serious engineer, installer, or project manager, the real work begins after you’ve narrowed it down to bankable manufacturers.

Your final decision should always come down to the panel’s spec sheet and how well it fits your specific project. Think of it like this: Tier 1 status gets a manufacturer an invitation to the party, but the panel's actual performance is what earns it a spot on the roof.

Your Technical Evaluation Checklist

Before you sign off on any module, you have to get granular with the data sheet. These four metrics are non-negotiable for evaluating a panel's real-world value.

- Panel Efficiency (%): This tells you how much sunlight the panel converts into usable electricity. Higher efficiency is a game-changer when you're working with limited roof or ground space, as you'll need fewer panels to hit your target output.

- Temperature Coefficient: Heat is the enemy of efficiency. This number shows you exactly how much power a panel loses for every degree Celsius it heats up past the standard test temperature of 25°C. A lower coefficient—closer to -0.30%/°C—is always better, especially for projects in hot climates like Arizona or Texas.

- Power Tolerance: This is the manufacturer's guarantee of output. A tight positive tolerance, like +5W/0W, means the panel will produce at least its rated wattage, never less. You get what you paid for, and then some.

- Degradation Rate: Every panel loses a bit of steam over time. The spec sheet details the maximum drop in performance for the first year and the years that follow. A lower degradation rate translates directly to more energy and a better return over the system's 25-year life.

Product vs. Performance Warranties

It's critical to know the difference between the two warranties that come with every panel. They cover completely different things.

The Product Warranty (typically 12-25 years) covers physical defects in materials and workmanship—things like a cracked frame, delamination, or a bad junction box. The Performance Warranty (usually 25-30 years) is a guarantee that the panel will maintain a certain level of power output over time (e.g., no more than 0.5% degradation per year).

A solid Tier 1 manufacturer will offer strong terms on both fronts. When you're comparing your options, dig into the specific terms, not just the number of years. For a deeper dive into how different manufacturers stack up on warranties, our guide to the best solar panel brands breaks down exactly what to look for.

The process is simple: Start with bankable Tier 1 brands, then get ruthless with the technical specs to find the perfect match for your project's demands.

The Rise of US-Based Tier 1 Production

For anyone in the solar game—developers, EPCs, and procurement managers—sourcing domestically made panels isn't just a "nice-to-have" anymore. It's a massive strategic advantage. Thanks to incentives like the Inflation Reduction Act (IRA), the boom in US solar manufacturing is making solar panel tier 1 modules more available than ever.

This shift to domestic production solves some of the biggest headaches in a project's lifecycle. Getting panels from a US factory means no more waiting for containers to cross the ocean, slashing logistical risks, and making it way easier to comply with federal rules like the Buy American Act (BAA).

Maximizing Incentives and Project Security

This trend has a direct, positive impact on how projects are bought and financed. A stable, domestic supply chain means less worrying about international trade wars and a much more predictable delivery schedule. For large-scale projects, that’s everything when it comes to staying on track and on budget.

This isn’t just some future prediction; it's happening right now. In the first quarter of 2025 alone, the US solar industry fired up a staggering 8.6 GW of new solar module manufacturing capacity. That's a huge surge, and it's essential for building a tough national supply chain that already supports the 10.8 gigawatts of solar installed in that same quarter. You can dig into the numbers yourself in the latest Solar Market Insight Report.

Pro Tip for Government and Commercial Projects: If you want to squeeze every last drop out of federal incentives, specifying US-made Tier 1 panels is the most direct way to do it. It’s a clean path to compliance for public-funded projects or any job aiming for the full suite of IRA benefits, which makes the project more bankable and boosts the overall ROI. This is a critical conversation to have during the procurement phase to avoid costly compliance missteps later.

For developers deep in government, commercial, or utility-scale work, tapping into this growing domestic production is a power move. It locks in project security, smooths out compliance, and lines up your procurement strategy with the biggest federal incentives on the table—giving you a serious competitive edge.

Frequently Asked Questions

Even when you know what a solar panel tier 1 rating means, a few specific questions always pop up when it's time to actually buy the panels. We get these all the time from installers and developers in the field. Getting the details right is the difference between a good project and a great one, so let's clear up the common sticking points.

We've put together some quick answers to the questions we hear most often.

| Question | Short Answer |

|---|---|

| Is Tier 1 always the best quality? | No. It's about the manufacturer's financial stability, not a direct measure of panel performance. |

| Does the Tier 1 list change? | Yes, it's updated quarterly by BloombergNEF, so always check the latest version for financed projects. |

| Are Tier 2 panels a bad investment? | Not always. They can be a solid choice for cash-funded projects, but they're often a no-go for bank-financed deals. |

| Where can I find the official list? | It's a subscription-based report from BloombergNEF, but our team at Portlandia has access to guide your selections. |

Now, let's dive a little deeper into each of these.

Is a Tier 1 Solar Panel Always the Best Quality?

Not necessarily, and this is a huge point of confusion. Think of the Tier 1 ranking as a measure of the company, not the panel. It’s all about financial health and bankability—is this manufacturer a safe bet for a 25-year investment?

A Tier 1 brand is financially sound, but you still need to get into the weeds of the spec sheet. Look at the real performance metrics—efficiency, temperature coefficient, and degradation rates—to see if it’s the highest-quality panel for your specific job.

Does the Tier 1 List Change Frequently?

Yes, absolutely. The list is a living document. BloombergNEF revisits and updates its rankings every quarter.

A manufacturer can get added or dropped based on their recent project financing, how many panels they're making, and their overall financial stability. That’s why it’s critical to use the most current list when you're making purchasing decisions, especially for any project that involves a lender.

Are Tier 2 Panels a Risky Investment for Commercial Projects?

They can be, but it really boils down to how the project is funded and your tolerance for risk.

If a commercial client is paying cash and the main goal is to lower upfront costs, a reputable Tier 2 manufacturer with a proven track record can be a perfectly good option. However, if the project needs non-recourse financing from a bank, lenders will almost always balk at Tier 2 panels. They see it as an unnecessary risk, which makes Tier 1 the only practical choice in those scenarios. Understanding the long-term advantages of solar power energy helps put this investment decision into perspective.

Where Can I Find the Official Tier 1 Solar Panel List?

The one and only official list is put together by BloombergNEF (BNEF). It’s not something you can just Google; it's a subscription-based report that costs a fair bit of money.

The good news? Here at Portlandia Electric Supply, our team maintains access to this data. We can guide you in picking modules that meet the latest bankability standards for any project you’re working on.

Ready to spec your next project with bankable, high-performance solar panels? Portlandia Electric Supply offers a massive in-stock inventory of Tier 1 modules, backed by NABCEP-certified design support and nationwide logistics. Request a Quote