What is Net Energy Metering? A Complete Guide for Installers & EPCs

Share

Net Energy Metering (NEM) is a critical billing policy that allows solar system owners to get financial credit for the excess electricity they generate and send to the grid. For solar installers, EPCs, and project developers, understanding NEM isn't just a technical detail—it's the financial engine that determines a project's payback period, ROI, and overall viability. Without a strong NEM policy, the economic case for grid-tied solar weakens significantly.

This guide provides the operational clarity you need. We'll break down how NEM works in the real world, its direct impact on project financials, and how to navigate the complex landscape of state-level policies to deliver profitable, compliant systems for your clients.

A Practical Guide to Net Energy Metering

If you’re a solar installer, a commercial EPC, or a facility manager, getting a firm grip on net energy metering is non-negotiable. This isn't some minor technicality; it's the financial backbone of nearly every grid-tied solar project you will bid on or build.

A favorable NEM policy is what makes the numbers work. It directly shapes the payback period, the final return on investment (ROI), and the entire sales pitch to your clients. Frankly, without a solid NEM framework in place, the economic case for going solar gets a whole lot tougher.

- For Installers: NEM dictates the savings you can promise customers, directly impacting your sales conversion rates.

- For EPCs & Developers: NEM policies are a primary factor in financial modeling and risk assessment for commercial and utility-scale projects.

- For Facility Managers: Understanding NEM is key to accurately forecasting energy cost reductions and justifying capital expenditure on solar assets.

Core Concepts Explained

The core principle of NEM is to compensate solar system owners for the clean energy they contribute to the grid. It allows anyone generating their own electricity to export their surplus power and receive credits that offset the cost of power they draw from the grid later.

In essence, NEM lets your project use the grid as a massive, shared battery, storing the value of your excess generation without the capital cost of physical battery banks. The impact is huge. In California, NEM systems have supplied nearly 15% of the state’s electricity demand during peak solar production hours, a critical factor in grid stability. You can dig deeper into these impacts by checking out this NREL report on NEM policies.

To make it even clearer, here’s a quick breakdown of how the components of NEM work together.

Net Energy Metering At a Glance

| Component | How It Works for a System Owner | Primary Financial Benefit |

|---|---|---|

| Excess Generation | Solar panels produce more power than the building is using, especially midday. | Prevents energy waste and monetizes every kilowatt-hour generated. |

| Grid Export | Surplus power automatically flows from the site to the local utility grid. | Clean energy helps power neighboring homes and businesses, supporting grid reliability. |

| Billing Credits | The utility measures this exported energy and applies a credit to the monthly bill. | Credits directly offset the cost of electricity used from the grid at night or on cloudy days. |

This table shows the straightforward, practical flow of energy and value under a NEM policy. For project developers and EPCs, the takeaway is simple: you can design a system to maximize its annual energy production, knowing that every single kilowatt-hour has direct financial value—whether it’s used on-site or sent to the grid.

How Net Energy Metering Works Day to Day

To really understand net energy metering, you need to follow the journey of a single kilowatt-hour (kWh). The entire system hinges on one crucial piece of hardware: a bidirectional meter. Unlike a traditional meter that only tracks consumption, this device meticulously tracks electricity flowing both ways—from the grid to your site, and from your site back to the grid.

In the middle of a sunny day, a solar array is often producing more power than the building needs. That excess energy is automatically exported to the local grid, causing the bidirectional meter to effectively spin backward. Every kWh exported is logged as a credit.

Then, as the sun sets or cloud cover increases, the solar array's output drops. The building simply pulls the power it needs from the grid, and the meter tracks this consumption just like a standard meter would.

The Daily Cycle of Production and Consumption

It’s a continuous balancing act, and the meter is the referee. A solar system's first job is always to power the on-site load—lights, HVAC, and equipment. Only the true surplus gets exported.

- Morning: Solar production ramps up, first reducing the amount of power being purchased from the utility.

- Midday: This is peak production. The system is likely generating more power than the site can use, so a significant amount flows to the grid, racking up valuable NEM credits. To get a better handle on these patterns, check out our guide on optimizing solar energy production.

- Evening: As production drops to zero, the site draws 100% of its power from the grid, using the credits banked earlier in the day to offset the cost.

This entire cycle is automated. The bidirectional meter acts as a silent accountant, tracking every watt without any manual intervention.

How NEM Credits Impact Your Utility Bill

At the end of the billing period, the utility reconciles the account. They take the total kWh imported from the grid and subtract the total kWh exported to it. The customer only pays for the "net" difference.

For Project Developers & EPCs: This is the heart of the financial model. Wiping out the cost of expensive peak-hour grid power with banked solar credits is what makes the ROI on these projects compelling. It transforms an intermittent energy source into a predictable financial asset.

Let's look at a quick, real-world example to see how this plays out.

Example: A Commercial Office Building

Picture a standard office building with a 100 kW solar array on its roof. During business hours (9-to-5), the building is using a lot of power, but the solar system is also at peak production, often generating more than enough to cover it.

- kWh Exported (Midday Surplus): 10,000 kWh

- kWh Imported (Nights & Weekends): 8,000 kWh

At the end of the billing cycle, the calculation is simple: 8,000 kWh imported minus 10,000 kWh exported. The result is a net surplus of -2,000 kWh. This means the building owner doesn’t just get a $0 electricity bill—they now have a 2,000 kWh credit to roll over and apply to next month’s usage.

The Financial Impact of NEM on Solar Investments

Let's get down to brass tacks. Net energy metering isn't just a billing mechanism; it's the linchpin that determines if a solar project is financially brilliant or merely a break-even proposition. For developers and EPCs, a solid grasp of NEM isn’t just an advantage; it’s the difference between a home-run investment and a project that struggles to find funding.

A strong NEM policy is the engine driving your return on investment. It directly slashes the payback period and boosts the overall ROI.

At its core, the financial magic is simple: NEM lets a system owner swap expensive electricity from the grid for credits they earn sending their own low-cost solar power back. This is what supercharges the timeline for the system to pay for itself. The proof is in the numbers—policies like NEM are a huge reason solar has exploded globally. In recent years, global PV capacity additions hit between 554 GWdc and 602 GWdc, a boom largely fueled by consumer-level incentives that make solar a no-brainer.

You can dig into the specifics in the IEA-PVPS Snapshot of Global PV Markets 2025.

Favorable NEM vs. Net Billing: A Financial Snapshot

To see how this plays out in the real world, you just have to compare the project economics under different tariff structures. The swing in ROI can be massive, which is exactly why the fine print of any policy matters so much when you're running the numbers.

-

Retail-Rate NEM Policy: Under a legacy NEM 1.0 or 2.0 policy, every kilowatt-hour exported is credited at the full retail price. It’s a clean, one-to-one trade. This maximizes the value of every single electron the panels produce and can shorten the payback period to just 5-8 years for commercial projects.

-

Net Billing Tariff: Newer policies often switch to a "net billing" model. Here, the energy exported is valued at a much lower wholesale or "avoided cost" rate. This can stretch the payback period out to 10-15 years or even longer, putting a serious dent in the project's lifetime ROI.

For a closer look at other financial mechanisms that can make or break a project, it's worth exploring programs like the funding from the California Energy Commission.

Pro Tip for Installers and EPCs

Stop talking about NEM as a technicality. Frame it as the core financial engine of the deal. Show your client two clear scenarios: one with today's NEM policy and another with a less-favorable tariff. This contrast instantly shows them the value on the table and creates a real sense of urgency to lock in the current benefits. It turns a boring policy chat into your most powerful closing tool.

Navigating Different Net Metering Policies

Here's a hard truth for solar professionals: not all Net Energy Metering (NEM) policies are created equal. If you're working across different states—or even just neighboring utility territories—this is something you learn fast.

The rules that dictate how your customer gets credited for the solar energy they send back to the grid can change dramatically from one town to the next. These variations have a direct, and often massive, impact on project economics and customer ROI.

A system design that’s a home run in one market could be a financial dud just a few miles away. Staying on top of these rules isn't just good practice; it's essential for accurate financial modeling and maintaining your credibility as an expert.

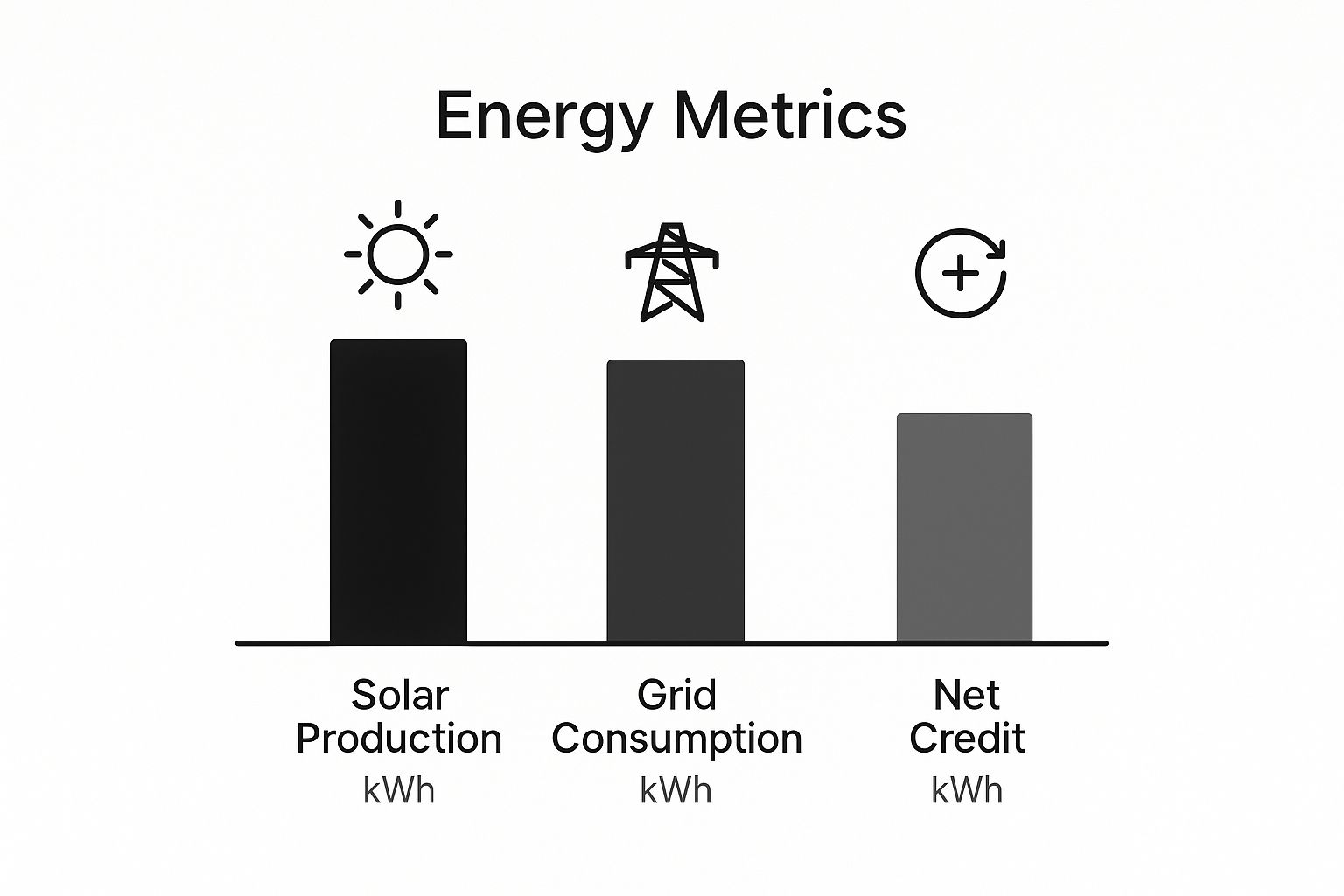

This image breaks down the relationship between what a solar system produces, what a home consumes from the grid, and how the net credit shakes out on a utility bill.

As you can see, the goal is always to generate more than you consume. But the actual dollar value of that surplus power is completely at the mercy of local policy.

From NEM 1.0 to Successor Tariffs

The world of solar compensation is always in motion. As distributed generation grows, many states are moving away from traditional NEM frameworks to new models they argue better reflect the true cost of managing the grid.

Here are the big three you'll run into:

-

Traditional NEM (NEM 1.0/2.0): The classic model. For every kWh you export, you get a credit worth the full retail rate of a kWh you'd buy from the utility. It's a simple, one-for-one swap that delivers the fastest payback for the system owner.

-

Net Billing: The most common replacement for traditional NEM. Instead of the retail rate, your exported energy is credited at a much lower value—often tied to the utility's "avoided cost" or the wholesale price of power. This significantly slashes the value of excess kilowatt-hours.

-

Buy-All, Sell-All (BASA): In this setup, the system owner sells 100% of their solar energy directly to the utility at a predetermined rate. They then buy back all the electricity they need from the grid at the standard retail price. The financial outcome hinges entirely on the gap between those two rates.

These policy shifts aren't just happening in the U.S. As global investments in renewables soared to USD 728 billion, countries worldwide started rethinking their solar compensation rules. The UK and Denmark, for example, have closed their generous feed-in tariff programs, while places like Greece and South Africa are adopting net billing to manage grid integration costs.

Comparison Matrix: Common Solar Compensation Policies

To make sense of how these different policies affect a project's bottom line, it helps to compare them side-by-side. Each model creates different incentives, and understanding the nuances is key to giving your clients sound advice.

| Policy Type | Export Credit Value | Best For | Common U.S. Example |

|---|---|---|---|

| Traditional NEM | Full Retail Rate | Maximizing ROI for solar-only systems without storage. | States with legacy NEM 1.0 or 2.0 policies still in place for existing customers. |

| Net Billing | Avoided Cost / Wholesale Rate | Encouraging self-consumption and pairing solar with battery storage. | California's NEM 3.0, which significantly reduced export compensation. |

| Buy-All, Sell-All | Fixed Contract Rate | Utility-scale projects or situations with predictable, contracted energy prices. | Certain community solar programs or utility-specific tariff structures. |

As the table shows, the trend is moving away from the simple retail-rate swap and toward models that incentivize energy storage and on-site consumption.

State-Level Policy Matters Most

The shift from one NEM framework to another can completely upend a solar market. California’s infamous move to NEM 3.0, for instance, torpedoed export credit values so badly that energy storage became almost mandatory for new solar projects to make financial sense. Similar battles are being fought in statehouses across the country.

Compliance Watchout: Regional Policy Variation

Never assume a one-size-fits-all approach. A project plan that is profitable in one utility territory can be a financial failure just one county over. Always verify the specific, current tariff documents and interconnection rules for every single project address before finalizing a proposal. This diligence prevents inaccurate financial projections and protects your reputation. For a real-world look at this, check out our guide on solar power incentives in PA.

Adding Energy Storage to Maximize NEM Benefits

In markets where Net Energy Metering (NEM) rules are getting tighter, just putting panels on the roof is only half the battle.

Utilities are rapidly moving away from generous one-to-one credits toward Net Billing and complex Time-of-Use (TOU) rates. In this new landscape, an energy storage system transitions from a nice-to-have upgrade to a core component of a project's financial strategy. This is where pairing solar with a battery really changes the game.

Modern policies often gut the value of solar energy exported to the grid, especially during midday when system production is highest. Instead of exporting that valuable electricity for pennies, a battery lets you capture and store it for later use, putting you back in control of your energy and your savings.

Store Low, Use High: The Energy Arbitrage Strategy

The strategy is brilliantly simple: store your own solar power when the utility will pay you next to nothing for it, then use that stored energy when grid power costs a fortune. This is what we in the industry call energy arbitrage, and it turns your system into a smart, money-making asset.

- Midday Solar Production: Your panels are pumping out cheap, clean electricity. Instead of exporting it to the grid for a pittance, you use that surplus to charge your battery.

- Evening Peak Demand: The sun goes down, and grid prices shoot up. Instead of paying the utility’s high rates, you simply switch over to your battery and power your home or business for free.

This approach insulates your client from the most expensive electricity rates and squeezes every last drop of value from their solar panels. It’s absolutely essential in states with policies like California's NEM 3.0.

For Installers and EPCs: The conversation with clients has to change. Energy storage isn't an add-on anymore; it's fundamental to maximizing ROI. Tier 1 brands like FranklinWH and Sungrow build sophisticated battery systems designed for exactly this—they can be programmed to charge and discharge based on the local utility's TOU schedule, hitting those savings targets automatically.

A Practical Use Case for NEM and Storage

Let's imagine a commercial building on a TOU rate plan. The utility charges $0.45/kWh during peak hours (5-9 PM) but only credits $0.05/kWh for solar exported during the day.

Without a battery, the business would be sending tons of power back to the grid for almost no financial benefit. By adding storage, they can bank all that midday solar energy. As soon as the 5 PM peak rates kick in, the battery takes over, running the facility and letting them sidestep those sky-high grid charges entirely.

This smart use of stored energy can slash electricity bills by an extra 30-50% compared to what a solar-only system could achieve under the same policy. By pairing generation with storage, you’re no longer just installing solar panels—you’re delivering a complete energy cost-management solution. To dig deeper into how these setups work, check out our guide on what an energy storage system is.

Implementing a Project Under Your Local NEM Framework

For any installer or EPC, the interconnection process is where the rubber meets the road. It’s what separates a smooth, profitable job from one that gets tangled in red tape and costly delays. Mastering your local Net Energy Metering (NEM) framework isn't just good practice—it's a critical operational skill.

The entire journey, from picking equipment to getting that final utility approval, demands precision. One small mistake on an application or a component that isn't on the approved list can send a project right back to the start, killing your timelines and eating into your margins.

Checklist: Essential Steps for NEM Interconnection

Getting a project from design to Permission to Operate (PTO) follows a predictable path. While details vary by utility, the major milestones are consistent. Use this checklist to ensure nothing is missed.

- [ ] System Design and Equipment Selection: Design a system that meets the client's energy goals and complies with all local NEM program rules. Select UL-listed inverters, modules, and racking that are on the utility’s approved equipment list. Brands like Sungrow, Fronius, and FranklinWH are typically approved, but always verify with the specific utility.

- [ ] Prepare the Interconnection Application: This is the most documentation-heavy stage. The application package must be perfect and typically requires a single-line diagram (SLD), a detailed site plan, spec sheets for all major equipment, and proof of insurance. There is zero room for error.

- [ ] Submission and Utility Review: Once submitted, the application is reviewed by the utility's engineering department to ensure it meets all technical and safety standards. This review can last anywhere from a few weeks to several months.

- [ ] Installation and Inspection: After receiving initial approval, build the system exactly as shown in the approved plans, following all National Electrical Code (NEC) requirements. After installation, the local Authority Having Jurisdiction (AHJ) will conduct a final inspection.

- [ ] Final Documentation and PTO: With a passed inspection, submit the final paperwork, including the inspection certificate, back to the utility. After a final review, they will issue the Permission to Operate (PTO)—the official green light to energize the system and connect to the grid.

Critical Mistake: Inaccurate Single-Line Diagrams

The most common cause of project delays is an inaccurate or incomplete single-line diagram (SLD). Your SLD must clearly show every major component, disconnect, wire size, and overcurrent protection device. Any discrepancy between the diagram and the as-built system will trigger an automatic rejection, forcing costly revisions and resubmissions that can delay PTO by weeks or months.

Nailing this process every time builds your reputation as a reliable and efficient pro. At Portlandia Electric Supply, our NABCEP-certified design team can review your plans to ensure they meet utility and NEC requirements, helping you avoid these common pitfalls.

A Few Common Questions About Net Metering

We get a lot of questions from installers, developers, and even curious homeowners about how net energy metering actually shakes out in the real world. Here are straight answers to the ones that pop up most often.

Do I Get a Check for My Excess Solar Energy?

Probably not. Think of Net Energy Metering less like a paycheck and more like rollover minutes for your electricity. When your panels produce more power than you're using, the utility company gives you credits on your bill.

Those credits are then used to cancel out the cost of any electricity you pull from the grid later, like at night or on a string of cloudy days. The actual dollar value of those credits is the key detail—it all comes down to your local NEM rules. Older policies might offer a sweet one-to-one swap at the full retail rate, but newer tariffs often value your extra energy at a lower, wholesale-based rate.

What Happens If I Have Leftover Credits at The End of The Year?

This is where the annual "true-up" comes in, and you absolutely have to know your utility's rules. They vary wildly from one place to the next. Some utilities might cut you a check for any net surplus energy you've accumulated over the year, but they'll almost always pay you out at a rock-bottom wholesale rate.

Critical Compliance Note: Be warned—many utilities simply wipe your credit balance clean at the end of the true-up period. No payment, no rollover. It's crucial for installers and system owners to confirm the local true-up policy before designing a system to avoid leaving money on the table.

Is Net Energy Metering Available Everywhere in The US?

Definitely not. There's no federal law for NEM, so it's a patchwork of state and local utility regulations that are constantly in flux. One state might have a great program, while the neighboring one has something completely different or nothing at all.

This is why you must always verify the current, active regulations for the specific project address. Assuming the rules are the same from one town to the next is a classic, and often expensive, mistake.

Navigating the maze of NEM policies to design compliant, high-ROI solar and storage systems is what we live and breathe. At Portlandia Electric Supply, we provide the Tier 1 equipment, in-stock inventory, NABCEP-certified design support, and bundled logistics to make your projects successful. Request a Bulk Quote or contact an expert to streamline your next installation.