Solar Power Incentives in Florida: A Guide for Installers, EPCs, and Homeowners

Share

For solar installers, EPCs, and Florida property owners, the decision to invest in solar isn't just about sunshine—it's about project viability. Success hinges on a potent combination of incentives, starting with a massive 30% federal tax credit and layered with state-level sales and property tax exemptions. Failure to master these financial drivers means leaving money on the table and presenting uncompetitive proposals.

This guide provides an operational breakdown of the federal, state, and local incentives that directly impact project costs, ROI, and compliance in the Florida market. We will cover the critical details needed to build accurate financial models for commercial projects and deliver maximum value for residential clients.

Maximize Your ROI with Florida Solar Incentives

For anyone specifying or purchasing a solar system in Florida, the financial case goes far beyond a lower monthly power bill. The state’s incentive structure is deliberately designed to make solar energy an accessible, smart, and highly attractive investment. A firm grasp of how these incentives stack is the first step in demonstrating true project value.

The financial viability boils down to three pillars working in sync: the federal ITC, state tax exemptions that lower CapEx and OpEx, and solid net metering policies. When combined, they dramatically shorten the payback period and boost the overall ROI.

- For Installers & EPCs: Knowing these financial drivers inside and out is crucial for crafting proposals that not only make sense to clients but also paint an accurate picture of the long-term win, ensuring your bids are competitive and bankable.

- For Homeowners: Understanding these incentives allows you to verify quotes, accurately forecast your savings, and make a confident investment in your energy future.

Florida Solar Incentives At-a-Glance

This table serves as a quick-reference checklist for the primary financial incentives available for solar installations in Florida. Use this to frame project budgets and client conversations before diving into the specific compliance and application details.

| Incentive Name | Incentive Type | Governing Body | Primary Benefit & Impact |

|---|---|---|---|

| Residential Clean Energy Credit | Federal Tax Credit | U.S. Federal Government (IRS) | Reduces federal tax liability by 30% of the total installed system cost. |

| Solar & CHP Sales Tax Exemption | State Tax Exemption | State of Florida | Eliminates the 6% state sales tax on all solar equipment and labor, directly lowering upfront CapEx. |

| Property Tax Abatement | State Tax Exemption | State of Florida | Prevents property tax increases from the added value of the solar system, securing long-term operational savings. |

| Net Metering | Utility Bill Credit | Florida Utility Companies | Provides credits for excess energy sent to the grid, ensuring value for all generated power and shortening the payback period. |

The real financial impact is realized when these programs are stacked. For a typical Florida homeowner installing a solar power system, the combined federal and state incentives result in an average savings of around $8,200. That number reflects the federal credit, the property tax shield, and the upfront sales tax exemption.

Of course, financing plays a big role in your overall ROI, and understanding the ins and outs of local mortgage lead generation can help you build the right strategy for funding your system. And while the incentives are a huge part of the equation, so is the tech that makes it all work. To squeeze every last watt out of your investment, check out our guide on using a power optimizer for solar panels.

The Federal Solar Tax Credit Explained

For any solar project in Florida, the federal Investment Tax Credit (ITC) is the single most significant financial driver. Officially known as the Residential Clean Energy Credit, this is a powerful tool that delivers a direct, dollar-for-dollar reduction on federal tax liability.

For solar professionals—developers, EPCs, and installers—mastering the ITC is non-negotiable. It is the cornerstone of a winning proposal and the key to demonstrating project bankability. Understanding qualification requirements, covered costs, and the claim process is the first step to unlocking serious savings on any solar project.

Who Is Eligible and What Costs Are Covered

Eligibility for the federal solar tax credit is straightforward: the entity claiming the credit must own the solar energy system. This applies whether the system was paid for in cash or financed with a loan. Leased systems or projects under a Power Purchase Agreement (PPA) are not eligible for the owner to claim the credit. The system must also be new and placed in service during the tax year for which the credit is claimed.

A key strength of the ITC is its comprehensive coverage. The credit applies to the total gross system cost, which includes:

- Solar Panels (Modules): The core power-generating components of the system.

- Balance-of-System (BOS) Equipment: All critical hardware, including inverters (like those from Sungrow or Fronius), racking, wiring, and safety disconnects.

- Energy Storage Batteries: If paired with the solar array, battery systems from brands like FranklinWH or BYD with at least 3 kWh of capacity are eligible.

- Labor and Installation Costs: All costs associated with site preparation, assembly, and professional installation.

- Permitting Fees and Inspection Costs: Administrative and regulatory costs required to bring the system online.

This all-in-one approach ensures the credit accurately reflects the real-world project cost, maximizing the financial return for the system owner.

Calculating the ITC: A Practical Example

Let's run the numbers for a typical residential installation in Florida with a total project cost of $25,000.

- Determine the Credit Rate: For systems installed between 2022 and 2032, the federal tax credit is 30%.

- Calculate the Credit Value: Multiply the total system cost by the credit rate: $25,000 x 0.30 = $7,500.

- Apply to Tax Liability: This $7,500 is a direct, dollar-for-dollar credit. If the system owner has a federal tax liability of $10,000, this credit reduces their tax bill to just $2,500.

Critical Mistake to Avoid: When discussing the ITC with clients, always frame it as a potential tax credit, not a guaranteed cash rebate. Advise them to consult a qualified tax professional to understand how the credit applies to their specific financial situation. This protects you from providing unlicensed tax advice and ensures the client has accurate expectations.

Florida residents are cashing in on this 30% federal Investment Tax Credit (ITC), which is easily the most important solar incentive going into 2025. This credit covers the full freight—panels, batteries, labor, and permits. Even better, if the credit is more than what you owe in taxes, you can roll the rest over to future years. On a typical $20,000 solar project, that’s a $6,000 tax credit right off the top. You can find more strategies for getting the most out of these programs in the 2025 guide from castawaysenergy.com.

Understanding the Rollover Provision

A common scenario is a tax credit that exceeds the owner's tax liability for a given year. The ITC is non-refundable, meaning the IRS will not issue a cash refund for the difference. However, the provision allows for any unused credit to be rolled over to subsequent tax years.

For example, if a homeowner earned a $7,500 credit but only had a $5,000 federal tax liability, they would use $5,000 of the credit to eliminate their tax bill. The remaining $2,500 carries forward to reduce their tax liability in the following year. This ensures the full value of the incentive is eventually realized.

Federal incentive rules can change, so it's always smart to keep an eye out for any policy shifts. You can track updates on Major Home Energy, EV, and Solar Tax Credits to stay on top of any new deadlines or adjustments.

Unlocking Florida's State Solar Tax Exemptions

While the federal ITC provides a significant post-installation benefit, Florida's state-level incentives deliver immediate and long-term savings by targeting taxes directly.

These are not tax credits but powerful exemptions that slash upfront project costs and shield property owners from future tax increases. Understanding these two exemptions is mandatory for accurately modeling the financial performance of any solar project in the Sunshine State.

- For Developers & EPCs: These state-level exemptions are non-negotiable inputs for any financial model. They directly lower CapEx and long-term OpEx, making projects more attractive to investors.

- For Homeowners: This translates to simple, powerful benefits: immediate savings at the point of sale and long-term protection against rising property taxes.

The Solar and CHP Sales Tax Exemption

One of the most immediate financial wins is the Solar and Combined Heat and Power (CHP) Sales Tax Exemption. This state law completely eliminates Florida's 6% sales tax on all equipment for a solar energy system.

This saving is realized at the time of purchase, not as a future rebate. When you or your installer procures the equipment—panels, inverters, racking, BOS components—the 6% sales tax is simply not applied.

Let's quantify the impact. For a residential system with an equipment cost of $18,000:

- The standard 6% sales tax would be $1,080.

- This exemption reduces the project's initial cash outlay by that full $1,080.

For commercial-scale projects, this exemption can result in tens or even hundreds of thousands of dollars in direct CapEx reduction, significantly improving the project's bottom line.

The Property Tax Abatement for Renewable Energy

This is arguably the most critical long-term solar incentive Florida offers. The Property Tax Abatement for Renewable Energy Property addresses a major concern for any property owner: tax increases following a capital improvement.

Normally, adding a high-value asset like a solar array would increase a property's assessed value, leading to a higher annual property tax bill. Florida law prevents this.

The statute is clear: 100% of the assessed value that a solar system adds to a property is exempt from property taxes. You gain the increased property value without the corresponding tax liability.

This is a massive financial benefit. A study from Zillow found that homes with solar panels sell for 4.1% more on average. Florida’s tax abatement allows property owners to realize that equity gain without being penalized on their tax bill, year after year, for the entire life of the system.

How These Exemptions Shape Project Financials

For industry professionals, these two exemptions are foundational to any financial projection. The sales tax exemption lowers upfront capital requirements, while the property tax abatement provides long-term operational cost certainty.

Here’s the breakdown by audience:

- For Homeowners: You save thousands on day one and never worry about your property taxes increasing due to your solar investment for its 25-year+ lifespan.

- For Installers & EPCs: This is a cornerstone of a compelling sales proposal. Highlighting immediate sales tax savings and decades of property tax protection provides transparency and a strong competitive edge.

- For Commercial Developers: Your financial models become more robust. Lower initial CapEx and predictable, flat property tax liabilities simplify long-term OpEx forecasting, leading to a more bankable project.

By stacking these powerful state-level exemptions, Floridians can dramatically cut both the initial and ongoing costs of going solar. It truly makes it one of the smartest financial moves you can make for your home or business.

Understanding Florida's Net Metering Policy

Beyond upfront incentives, the engine driving the long-term ROI of a solar investment in Florida is net metering. This policy dictates how utility companies compensate solar owners for the excess energy they export to the grid, effectively turning the utility into a bank for clean energy.

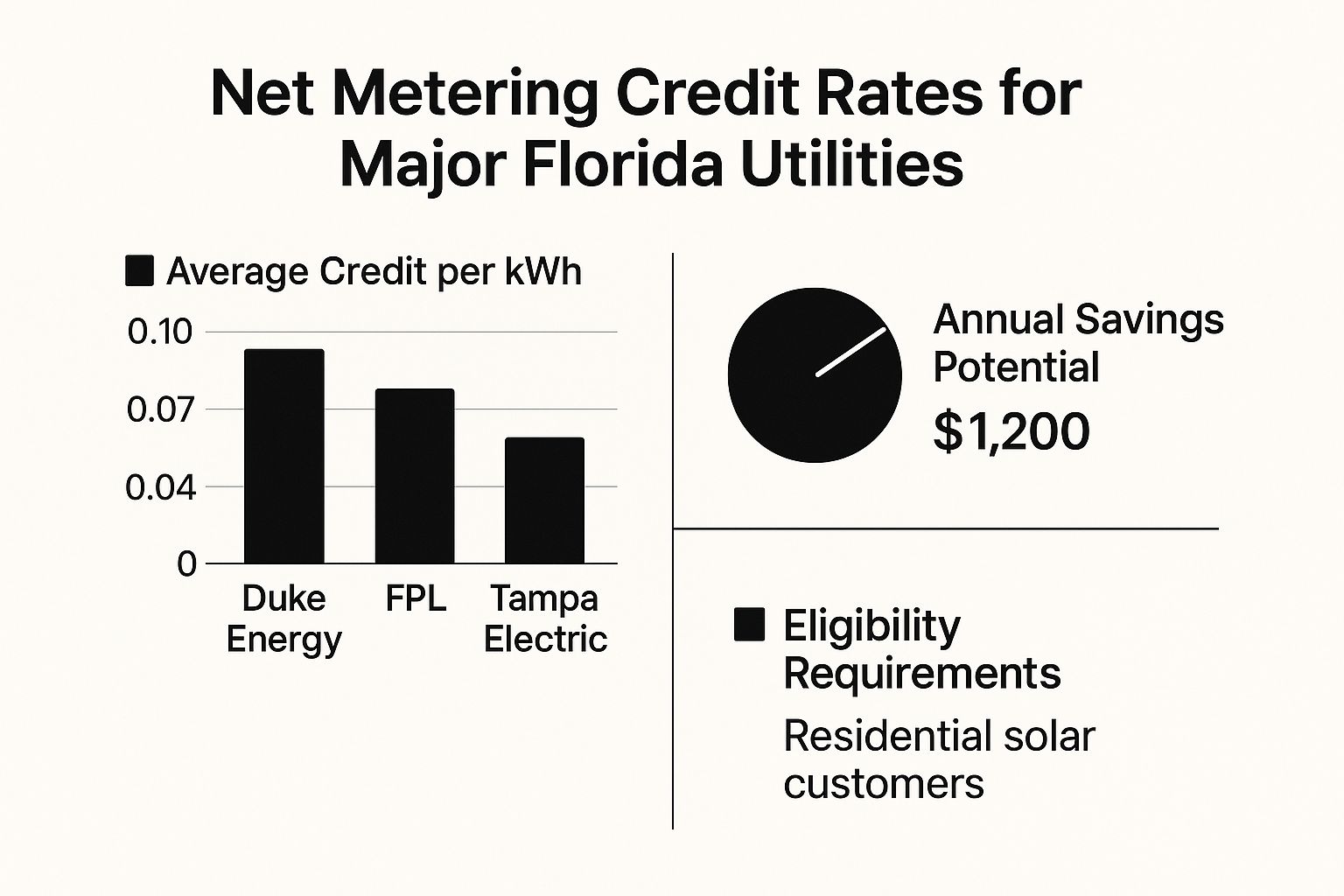

On a sunny Florida afternoon, a solar system often produces more power than the property consumes. This surplus energy flows onto the grid, and the property's electric meter runs in reverse, banking credits for later use. This mechanism ensures that every kilowatt-hour generated provides full financial value. It is a cornerstone of solar policy in Florida and is offered by all investor-owned utilities, including Florida Power & Light (FPL), Duke Energy, and Tampa Electric (TECO).

How Net Metering Credits Work

The critical component of Florida’s net metering rules is that utilities must credit solar customers at the full retail rate for every kilowatt-hour (kWh) exported to the grid. This creates a one-for-one exchange: the value of a kWh exported during the day is identical to the value of a kWh imported from the grid at night.

These credits appear on the monthly utility bill, directly offsetting the cost of any electricity consumed from the grid. If a system produces more energy than the property consumed in a given month, the excess credits automatically roll over to the next billing cycle, building a surplus for less sunny periods.

This consistent, retail-rate credit structure makes the financial return on solar predictable and stable, regardless of which major utility serves the property.

Credit Rollovers and Annual True-Up Periods

While credits roll over monthly, accounts are balanced annually in a process called the "true-up." At the end of a 12-month period, the utility reconciles the total energy produced against the total energy consumed.

If the system has "net excess generation" (NEG)—meaning it exported more energy to the grid over the year than the property consumed—the utility is required to pay for this surplus. However, this payment is calculated at the much lower "avoided-cost" rate, which reflects the wholesale price of power.

Expert Tip for Installers and Homeowners: The primary goal of system design should be to offset the property's annual energy consumption, not to operate as a miniature power plant. Oversizing a system to generate a large annual payout is a poor financial strategy, as the avoided-cost rate provides a very low return on the incremental investment in extra panels. A right-sized system maximizes the high-value, retail-rate credits.

For any solar professional, this is a critical design parameter and a key conversation to have with clients. A system designed to achieve net-zero annual consumption—potentially paired with an energy storage system from a brand like FranklinWH or Sungrow to maximize self-consumption—delivers the best financial outcome under Florida's current rules.

Net Metering Policies of Major Florida Utilities

While the core net metering framework is standardized, each utility has specific interconnection processes and timelines. The table below outlines the consistent financial structure across Florida's major investor-owned utilities.

| Utility Provider | Credit Rate | Annual Rollover/True-Up Policy | Key Considerations for Professionals |

|---|---|---|---|

| FPL | Full Retail Rate | Credits roll over monthly. Annual true-up pays out excess at the avoided-cost rate. | As the state's largest utility, FPL's interconnection queue can be long. Accurate system sizing is critical to maximize ROI. |

| Duke Energy | Full Retail Rate | Monthly rollover of credits. Any remaining balance is paid out annually at the avoided-cost rate. | Duke's policy mirrors the state standard, favoring self-consumption and precise system sizing. |

| TECO | Full Retail Rate | Unused credits roll over each month. Annual cash-out for net excess generation at the avoided-cost rate. | TECO's program is consistent with state rules, allowing for straightforward financial modeling in their service territory. |

The uniformity in credit valuation is a significant advantage for the Florida solar market, enabling installers and developers to create reliable financial models that apply across most of the state.

Compliance Watchout: The Status of Net Metering Legislation

Florida’s net metering policy has faced legislative challenges. In 2022, House Bill 741 was passed to phase down credit rates but was ultimately vetoed by the governor, preserving the current retail-rate structure. However, the policy remains a topic of debate. It is critical for all industry stakeholders to monitor potential regulatory shifts, as any changes would directly impact the financial viability of future solar projects. Always base ROI calculations on the most current regulations.

Finding Local and Utility-Specific Rebate Programs

While federal and state incentives form the foundation of solar savings, expert installers know that additional value can often be found at the local level. Florida has no statewide rebate program, meaning the most valuable solar power incentives in florida are often offered directly by municipal utilities.

These hyper-local programs serve as bonuses, designed by municipal utilities and electric co-ops to encourage solar adoption and reduce grid strain. For professionals, uncovering these incentives can be a key differentiator.

How to Uncover Local Incentives

These programs are not centralized and require direct research. The process is straightforward but essential for maximizing client savings.

Step-by-Step Checklist for Finding Local Rebates:

- Identify the Exact Utility Provider: Pinpoint the municipal utility or electric cooperative serving the project address. Incentives are strictly tied to specific service territories.

- Audit the Utility Website: Navigate to the utility’s official website. Search for sections labeled “Renewable Energy,” “Solar Programs,” “Energy Efficiency,” or “Rebates.”

- Execute Targeted Searches: Use the site’s search function with terms like “[Utility Name] solar rebate,” “[Utility Name] battery storage incentive,” or “renewable energy grants.”

- Contact the Source Directly: If a web search is inconclusive, call the utility’s customer service line. Ask to be directed to the renewable energy or energy conservation department to inquire about available programs.

Historically, utilities like the Orlando Utilities Commission (OUC) and Jacksonville Electric Authority (JEA) have offered such rebates. These programs are typically funded on an annual basis and operate on a first-come, first-served basis until funds are depleted, making timely application critical.

Pro Tip for Contractors and Installers

Maintaining a current database of these local programs can provide a significant competitive advantage.

Build an Incentive Tracking System: Create a spreadsheet or database of the utilities within your primary service areas. Assign a team member to check their websites quarterly for new programs, funding levels, and application deadlines. Being the first to inform a client about a new $500 or $1,000 rebate builds immense trust and can be the deciding factor in closing a deal.

Expand your search beyond solar PV rebates. Many utilities also offer incentives for high-efficiency HVAC systems, smart thermostats, or battery storage. Understanding how an energy storage system works can help you stack these incentives for a more comprehensive and valuable project proposal.

The Florida Solar Market Landscape for Professionals

For EPCs, developers, and installers, succeeding in Florida requires a clear understanding of its unique market dynamics. Unlike states with aggressive renewable energy mandates, Florida’s solar market is driven primarily by consumer economics and large-scale utility investment.

This is a market where project viability, not policy mandates, reigns supreme. Navigating this landscape effectively is key to capitalizing on the state's massive growth potential.

Navigating Policy Realities

Two policy factors fundamentally shape the Florida solar market. First, the state has no Renewable Portfolio Standard (RPS), meaning there is no legal requirement for utilities to source a specific percentage of their energy from renewables. Second, Florida law generally prohibits third-party Power Purchase Agreements (PPAs), removing a common financing vehicle for commercial solar projects.

The operational impact is clear: projects must be financially sound based on a direct ownership model. Viability hinges on the federal ITC, strong net metering rules, and the state tax exemptions that reduce costs. While this presents a challenge, it also fosters a market where only the most efficient and well-designed projects succeed.

To better understand the cost components of a successful project, review our detailed guide on commercial solar installation costs.

A Market Fueled by Growth and Demand

Despite the lack of an RPS, Florida’s solar market is one of the fastest-growing in the nation. The state ranks third for installed solar capacity, with enough to power over 2.35 million homes and a market valued at $28.2 billion.

This growth is not a product of government mandates. It is fueled by strong consumer demand for energy independence and lower utility bills, alongside massive investments by utilities in their own utility-scale solar farms. You can get the full picture from this SEIA report on Florida's market.

For professionals, the path to success is clear. The absence of certain policies has not hindered growth; it has defined it. Winning in Florida requires a laser focus on customer value, engineering systems that maximize the benefits of net metering, and securing a reliable supply chain partner like Portlandia Electric Supply who understands the local logistics and equipment needs.

Frequently Asked Questions About Florida Solar Incentives

Navigating tax codes and utility tariffs can be complex. Here are clear, no-nonsense answers to the most common questions we hear from installers and their clients.

Can I Claim Both Federal and State Incentives in Florida?

Yes, absolutely. This is a key advantage of the Florida market. The federal and state programs are distinct and designed to be "stacked."

- The Federal ITC: A tax credit that reduces your federal income tax liability.

- Florida's Exemptions: State-level benefits that reduce upfront sales tax and prevent future property tax increases.

Combining these incentives is the standard and correct way to maximize the financial return on a Florida solar installation.

Do I Get a Check Back for the Federal Solar Tax Credit?

No. This is a critical point of clarification for clients. The federal ITC is a non-refundable tax credit, not a cash rebate. It is applied directly against any federal income tax you owe. It can reduce your tax bill to zero, but the IRS will not issue a refund for any excess credit amount.

However, the rollover provision ensures you don't lose the value. If your credit is larger than your tax liability in one year, the unused portion carries forward to reduce your taxes in future years until the full credit is utilized.

Are Specific Solar Panel Brands Required for Incentives?

No. Neither the federal ITC nor Florida’s state tax exemptions mandate the use of specific equipment brands. As long as the system is new and comprised of components that meet U.S. safety and performance standards (e.g., UL certified), it is eligible. This applies to panels and inverters from all major manufacturers like BYD, Sungrow, FranklinWH, and Fronius.

Installer Tip: Always verify the requirements for local utility rebates. While major state and federal programs are brand-agnostic, a specific municipal utility might offer a limited-time rebate that requires equipment with certain efficiency ratings or certifications. Due diligence is essential before finalizing a bill of materials.

Ready to navigate the complexities of your next solar project in Florida? The experts at Portlandia Electric Supply provide the equipment, logistics, and compliance support you need. We offer bundled freight, kit pricing, and a massive inventory of Tier 1 brands. Request a Quote today to streamline your procurement.